Crypto Exchange Risk Checker

Is This Exchange Trustworthy?

Answer these questions about a cryptocurrency exchange to assess its risk level. Based on the C3 Crypto Exchange review, this tool highlights critical red flags.

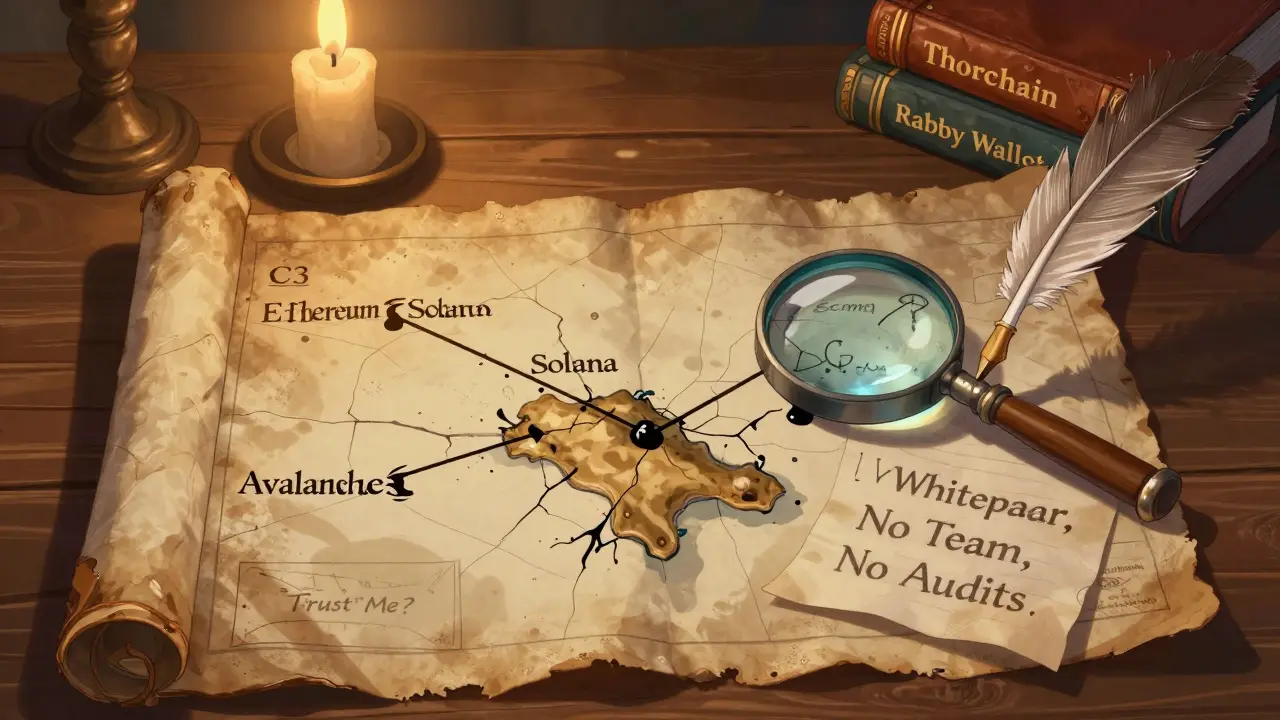

If you're looking for a crypto exchange that lets you keep full control of your coins while trading across multiple blockchains, you might have heard of C3 crypto exchange. But here’s the problem: there’s almost nothing reliable out there about it. No official user reviews. No clear fee schedule. No verified team members. No audit reports. And no mention of whether it’s even legal in your country.

Most exchanges you know-like Binance, Coinbase, or Kraken-have years of public history. They’re listed on major financial news sites, have millions of users, and their security practices are documented. C3 doesn’t have any of that. What it does have is a promise: you hold your keys, and you can trade between chains without wrapping tokens or using bridges. Sounds great. But is it real? Or just another shiny website with no substance?

What Is C3 Crypto Exchange?

C3 positions itself as a self-custodial, cross-chain crypto exchange. That means two big things:

- You keep your private keys. No one else has access to your funds.

- You can swap tokens across different blockchains-like Ethereum to Solana or Polygon to Avalanche-without needing third-party bridges.

This isn’t new. Other platforms like Uniswap, Thorchain, and Rabby Wallet do similar things. But C3 claims to do it faster, with lower fees, and without the complexity. The problem? There’s no proof.

There’s no whitepaper. No GitHub repo. No team bios. No LinkedIn profiles for the founders. Even the website’s domain registration is hidden behind privacy protection. That’s not normal for a legitimate exchange. Even smaller platforms like Bitget or KuCoin have public leadership teams and regulatory filings somewhere online.

Self-Custody: A Double-Edged Sword

Self-custody is the biggest selling point of C3. And honestly, it’s the right move. Centralized exchanges have lost billions in hacks-Mt. Gox, FTX, Crypto.com-all because they held users’ keys. When you control your own wallet, you eliminate that risk.

But here’s the catch: if you lose your seed phrase, or send funds to the wrong address, C3 can’t help you. No customer support team can recover your assets. No live chat can undo a mistake. You’re fully on your own.

Most users aren’t ready for that. A 2024 study by Chainalysis found that over 17% of new crypto users lost money because they didn’t understand wallet security. If C3 doesn’t have tutorials, in-app warnings, or recovery guides, it’s not just risky-it’s dangerous for beginners.

Cross-Chain Trading: The Real Tech Challenge

Trading across chains isn’t magic. It requires deep technical infrastructure. Most platforms use atomic swaps, liquidity pools, or relay chains to move assets. These systems are complex, expensive to build, and need constant maintenance.

For example, Thorchain runs a network of validators who lock and unlock assets across chains using threshold signatures. It took them years to get it right. And even then, they’ve had exploits and downtime.

C3 claims to do this without third-party bridges. That’s impressive-if true. But there’s zero technical documentation. No code samples. No API specs. No public node list. You can’t verify how it works. That’s a red flag.

Without knowing how C3 handles asset locking, transaction finality, or slippage control, you’re trusting a black box. And in crypto, black boxes are where money disappears.

Security: What We Don’t Know Could Hurt You

Security isn’t just about having a login page. It’s about:

- Multi-factor authentication (MFA)

- Cold storage for reserve funds

- Withdrawal whitelisting

- AI-driven fraud detection

- Regular third-party audits

None of these are confirmed for C3. The website mentions “security measures” and “access controls,” but that’s marketing speak. It doesn’t tell you if MFA is required. If withdrawals are delayed. If they use multi-sig wallets. If they’ve ever been hacked.

Even worse-there’s no public incident history. No reports of phishing attacks. No user complaints about frozen withdrawals. That’s not a sign of safety. It’s a sign of invisibility.

Compare that to Bitget, which published its 2024 security audit with CertiK. Or Kraken, which discloses its cold storage percentages. C3 says nothing. And silence in crypto isn’t trust-it’s risk.

Trading Pairs, Fees, and Liquidity

What coins can you trade on C3? No one knows. Is it just Bitcoin and Ethereum? Or does it support Solana, Cardano, Polygon, and newer Layer 2s? There’s no list. No trading pair page.

What are the fees? Is it 0.1%? 0.5%? Is there a flat fee? Do they charge network gas on top? Are there hidden costs for cross-chain swaps? No answers.

Liquidity is the silent killer of decentralized exchanges. If no one’s trading, your swap fails. Or you get 30% slippage. That’s not speculation-it’s fact. Uniswap V3 has over $10 billion in liquidity across all pools. C3? Zero public data.

You can’t trade effectively without knowing these numbers. And if you can’t find them, you shouldn’t be using the platform.

Regulation and Availability

Is C3 registered anywhere? With the SEC? The FCA? MAS? FINMA? The answer is unknown. That means if you live in the U.S., EU, UK, Australia, or Canada, you might be using an unlicensed service.

Unregulated exchanges can shut down overnight. Your funds can vanish. And you have no legal recourse. Even if you’re in a country with lax crypto laws, using an unregistered platform puts you at risk of fraud, scams, or being used as a money laundering channel.

And where can you use C3? Is it available in Brazil? Nigeria? India? The website doesn’t say. No country selector. No geo-block warning. Just a login button.

Real User Feedback? There Isn’t Any

Check Trustpilot. Check Reddit. Check Twitter. Check Crypto Twitter. Search “C3 exchange review.” You’ll find nothing. No threads. No complaints. No praise. No screenshots. No video tutorials.

That’s not normal. Even the smallest new exchange gets buzz. Someone tries it. Someone posts about it. Someone gets scammed and writes a warning.

But C3? Crickets. That doesn’t mean it’s a scam. But it does mean nobody trusts it enough to talk about it. And in crypto, trust is built on transparency-not promises.

How Does C3 Compare to Alternatives?

Here’s what you’re really comparing C3 to:

| Feature | C3 Crypto Exchange | Uniswap (Ethereum) | Thorchain | Rabby Wallet |

|---|---|---|---|---|

| Self-Custodial | Claimed | Yes | Yes | Yes |

| Cross-Chain | Claimed | No (Ethereum only) | Yes (15+ chains) | Yes (via bridges) |

| Public Team | No | Yes | Yes | Yes |

| Security Audits | Unknown | Multiple (OpenZeppelin, CertiK) | Published | Published |

| Trading Volume | Unknown | $1B+/day | $50M+/day | Not a DEX |

| Regulatory Status | Unknown | Unregulated | Unregulated | Unregulated |

| User Reviews | None | Thousands | Hundreds | Thousands |

Uniswap and Thorchain have flaws. They’re slow. They’re expensive on Ethereum. But they’re open. They’re audited. They’re used. C3 has none of that.

Should You Use C3 Crypto Exchange?

Here’s the honest answer:

- If you’re a seasoned crypto user who understands private keys, gas fees, and blockchain risks-you might experiment with a tiny amount.

- If you’re new, or you’re trading more than $500-you should avoid it.

There’s no reason to risk your money on a platform that won’t show you its cards. You wouldn’t hand your house keys to someone who won’t tell you their name. Don’t do it with your crypto either.

Stick to platforms with transparency. Use Uniswap for Ethereum tokens. Use Thorchain for cross-chain swaps. Use Rabby Wallet to manage your addresses. They’re proven. They’re open. They’ve been tested.

C3 might be the future. Or it might be vaporware. Right now, it’s a mystery. And in crypto, mysteries don’t pay off-they drain wallets.

What to Do Next

If you’re still curious about C3, here’s what you should do before touching a single coin:

- Visit their official website and look for a whitepaper, GitHub repo, or team page. If it’s not there, walk away.

- Search Reddit and Twitter for “C3 exchange scam” or “C3 exchange review.” If you find nothing, that’s a warning.

- Check if they list any regulatory licenses. If not, assume they’re not legal in your country.

- Try to contact support. See how fast they reply. If they don’t respond in 48 hours, it’s a sign they’re not serious.

- Only deposit what you’re willing to lose completely. And never use funds you need for rent, bills, or emergencies.

Crypto is full of opportunities. But the best ones don’t hide behind vague promises. They show their work. C3 doesn’t. And that’s the biggest red flag of all.

Ike McMahon

December 13, 2025 AT 04:50Don't touch this. I've seen this kind of site before-clean UI, no info, and then your funds vanish. Stick to Uniswap or Thorchain. Seriously.

Nothing to see here, move along.

PRECIOUS EGWABOR

December 14, 2025 AT 16:37Oh wow, another ‘self-custodial’ snake oil salesman with a domain registered under ‘Anonymous LLC’ and zero GitHub commits. How original. You’d think after FTX, people would learn that ‘we hold your keys’ is just code for ‘we’ll steal them later.’

Also, no team? No audits? Honey, this isn’t DeFi-it’s a TikTok scam with a whitepaper draft in Google Docs.

Kathleen Sudborough

December 16, 2025 AT 05:50I get why people are drawn to C3-the promise of cross-chain swaps without bridges is *so* tempting. I really want to believe it’s real.

But the silence is deafening. No team bios, no code, no audits… it’s like they built a Ferrari and never showed the engine. I’ve used Thorchain and Rabby, and even though they’re not perfect, at least you can see how they work.

If C3 is legit, they need to open up. Not just for trust-but for safety. New users are gonna lose everything here if they don’t warn them. Please, someone reach out and ask them for a live AMA. If they ghost it, that’s your answer.

Caroline Fletcher

December 17, 2025 AT 19:45Of course it’s a CIA project. Why else would they hide the domain? They don’t want you to know they’re using your trades to fund black ops. Also, the ‘no bridges’ thing? That’s just a cover for quantum tunneling through the blockchain multiverse. You think you’re swapping ETH for SOL? Nah. You’re feeding data to a satellite that sells your seed phrase to China.

Also, I heard they’re owned by the same people who made the Bitcoin Pizza guy rich. Coincidence? I think not.

Heath OBrien

December 18, 2025 AT 11:21Taylor Farano

December 18, 2025 AT 20:23Let me guess-the whitepaper is a 12-slide Canva doc titled ‘C3: The Future of Finance (Draft v0.1).’

And the ‘team’ is three Discord mods with the same profile pic of a mountain. The whole thing smells like a rug pull pre-launch.

Fun fact: every exchange that claims ‘no bridges’ without open-source code is either lying or has a dev who hasn’t slept since 2021. Spoiler: it’s the lying one.

Toni Marucco

December 20, 2025 AT 16:27The philosophical underpinning of decentralized finance rests upon the axiom of verifiable transparency. C3, in its current manifestation, violates this principle at every ontological layer.

Self-custody, while ethically laudable, becomes a moral hazard when divorced from accountability. One cannot invoke the virtues of autonomy while simultaneously obfuscating the architecture that enables it.

This is not merely a risk-it is an epistemological void. In the absence of demonstrable proof, trust cannot emerge; it can only be assumed. And assumption, in the realm of digital assets, is the prelude to ruin.

One must ask: is the promise of speed worth the sacrifice of epistemic integrity? I submit that it is not.

Kathryn Flanagan

December 22, 2025 AT 11:32Hey everyone, I just want to say I totally get why you're scared about C3. I was new once too, and I almost lost everything because I trusted a site that looked nice but had no info.

Here’s what helped me: I started with tiny amounts. Like, $5. I watched videos on how wallets work. I read Reddit threads for hours. I didn’t rush. And I asked questions-even if I felt dumb.

If you’re thinking about trying C3, just don’t put in rent money. Put in what you can lose. And if you’re not sure? Wait. There’s no prize for being first. The smartest traders are the ones who wait and watch.

You’re not behind. You’re just being careful. And that’s okay. Really. You’re doing great.

amar zeid

December 22, 2025 AT 22:57Interesting analysis. I checked C3’s domain WHOIS-registered via Namecheap privacy, last updated 3 weeks ago. No DNS records pointing to any known infrastructure. Zero social media engagement beyond a single tweet from a bot account.

Also, their ‘cross-chain’ claim contradicts blockchain fundamentals. True atomic swaps require validator networks. No validators = no swaps. Just a frontend with a fake API.

My advice: if it doesn’t have a GitHub with at least 50 commits and 3 contributors, it’s not DeFi. It’s a landing page.

Alex Warren

December 24, 2025 AT 15:58Steven Ellis

December 25, 2025 AT 18:32I’ve spent years in this space, and I’ve seen a lot of shady platforms. But C3? It’s on another level. The absence of information isn’t just a red flag-it’s a neon sign screaming ‘exit scam in progress.’

Self-custody is powerful, yes. But power without accountability is tyranny. And in crypto, tyranny is measured in lost private keys.

If you’re considering using this, please, for your own peace of mind, don’t. Use Thorchain. Use Uniswap. Use Rabby. They’re not perfect, but at least you can trace their footsteps.

C3? There are no footprints. Only shadows.

Claire Zapanta

December 27, 2025 AT 05:18Of course the UK government is behind this. They’re using C3 to track crypto users under the guise of ‘innovation.’ That’s why they hide the domain-so you think it’s a rogue operation. Classic false flag. And the ‘no bridges’ claim? That’s just a cover for quantum surveillance through Ethereum’s mempool.

Also, I heard the CEO is a former MI6 agent who moonlights as a crypto miner. Don’t believe me? Check the IP address. It’s routed through a Ministry of Defence server in London.

They’re not trying to build an exchange. They’re building a surveillance state. And you’re handing them your keys like a good little citizen.

Sue Gallaher

December 27, 2025 AT 13:44Jeremy Eugene

December 28, 2025 AT 17:24Thank you for this thorough and well-reasoned breakdown. I appreciate the balanced tone and the emphasis on verifiable facts over speculation. In an environment saturated with hype and fearmongering, your analysis provides a necessary anchor.

For those considering engagement with platforms like C3, I would respectfully suggest adopting a principle of ‘trust, but verify’-and in this case, verification is not merely advisable, it is non-negotiable.

One’s capital deserves the same diligence as one’s personal security. This is not caution-it is responsibility.

Kathy Wood

December 29, 2025 AT 15:27