Venezuela Crypto Value Calculator

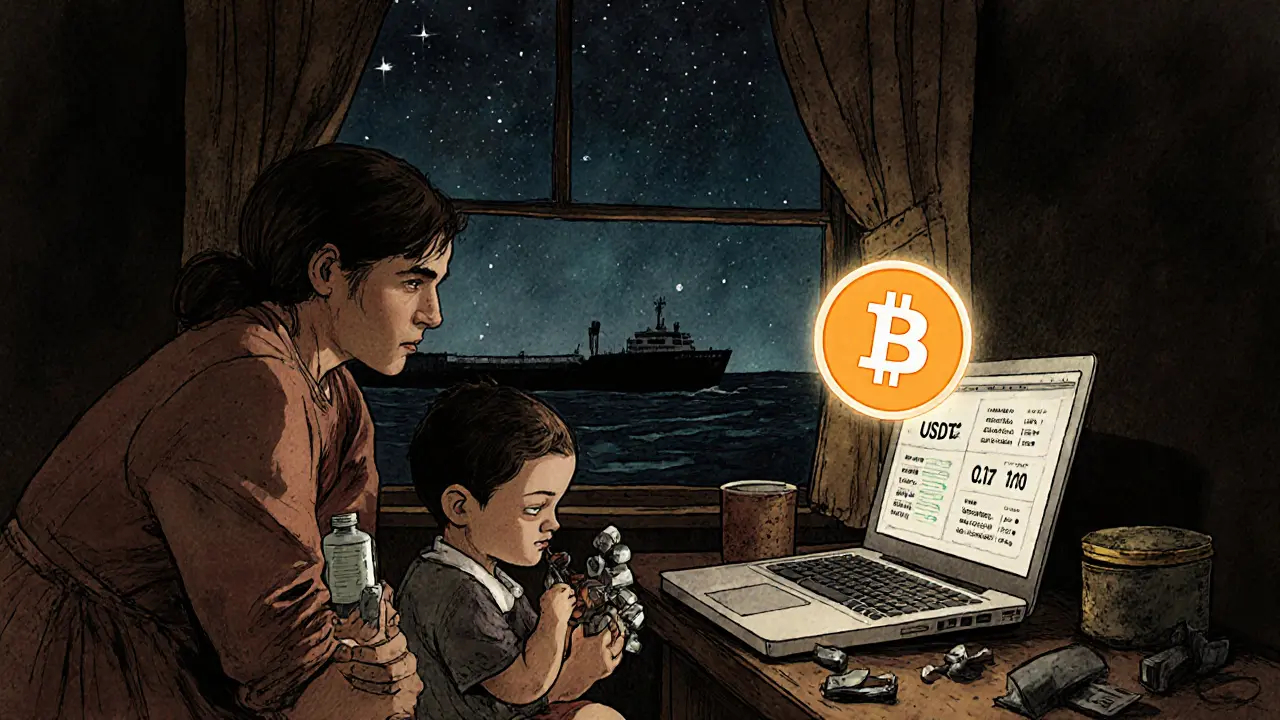

Venezuela's hyperinflation reached 10 million% in 2019. When the bolivar becomes worthless, crypto provides a lifeline. This tool demonstrates how much value you'd preserve by converting bolivars to USDT (a dollar-pegged stablecoin) during hyperinflation.

The U.S. dollar-pegged USDT (Tether) has become Venezuela's de facto currency for daily survival. Unlike volatile Bitcoin, USDT provides stable value for essential purchases like food, medicine, and internet access. The government actively encourages crypto use while simultaneously using it to bypass sanctions.

When Venezuela’s economy collapsed, its currency became nearly worthless. Hyperinflation hit 10 million percent in 2019. People couldn’t buy food with cash. Banks refused to serve them. Western sanctions cut off access to dollars, international banks, and global markets. But something unexpected happened: ordinary Venezuelans started using Bitcoin and stablecoins to survive. And the government? It turned that chaos into a weapon.

The PETRO: A Sanctions-Busting Experiment

In 2018, Venezuela launched the PETRO - the world’s first national cryptocurrency backed by oil reserves. Officially, it was meant to fight inflation. Unofficially, it was a lifeline for the regime to dodge U.S. and European sanctions. President Nicolás Maduro didn’t hide the goal. He said the PETRO would let Venezuela trade oil without using the dollar system. That meant bypassing SWIFT, avoiding U.S. banks, and slipping past financial restrictions. The PETRO was never a success as a currency. No one outside Venezuela wanted it. But it didn’t need to be. Its real purpose was to create a legal cover for crypto transactions. By tying the PETRO to oil, the government claimed it was a "real asset" - even though no one could verify the oil backing. The U.S. Treasury quickly banned Americans from dealing with it, calling it an extension of Venezuelan debt. But that didn’t stop the regime from using it as a front.State-Controlled Exchanges: The Gateway to Global Crypto

Venezuela didn’t just create a coin. It built an entire crypto infrastructure - and kept it under government control. Seven crypto exchanges were authorized to operate, and at least one, Criptolago, is directly owned by the Zulia state government. Its manager, Governor Omar Prieto, is under U.S. sanctions for blocking humanitarian aid. That’s not a coincidence. This isn’t private innovation. It’s state-run financial evasion. These exchanges don’t just trade PETRO. They handle Bitcoin, Ethereum, and especially Tether (USDT). Why USDT? Because it’s pegged to the U.S. dollar. It moves like cash, but without banks. For Venezuelans, it’s a way to hold value. For the regime, it’s a way to receive payments from abroad without triggering sanctions alerts.Oil, Crypto, and Shadow Ship Transfers

The real money isn’t in the coins - it’s in the oil. Venezuela’s state oil company, PDVSA, started using crypto to sell crude when traditional buyers vanished. The U.S. Department of Justice exposed a scheme in 2022: five Russian nationals helped PDVSA launder money by converting oil sales into cryptocurrency. How? Through ship-to-ship transfers in international waters. One tanker would meet another far from shore, transfer the oil, and then receive payment in USDT. No paper trail. No bank records. Just blockchain addresses. This method works because crypto transactions are fast, irreversible, and hard to trace - especially when mixed through multiple wallets. The regime doesn’t need to move money directly. It uses intermediaries: Russian traders, Turkish brokers, even Chinese firms. The money ends up in wallets linked to sanctioned individuals. And because Venezuela’s financial system is already broken, no one checks.

OTC Brokers: The Hidden Backbone of the Crypto Economy

In Caracas, you won’t find a bank. But you’ll find OTC brokers - cash-for-crypto dealers operating out of storefronts, cafes, and even parking lots. These brokers are the real engine of Venezuela’s crypto economy. A person walks in with a stack of bolivars, gets paid in USDT, and sends it overseas. A business receives oil payment in crypto and converts it to cash for payroll. It’s informal. It’s unregulated. And it’s completely essential. These brokers aren’t just helping citizens survive. They’re enabling sanctions evasion. A single broker might process hundreds of transactions a day. Some are legit. Many aren’t. Financial investigators now watch for patterns: sudden spikes in USDT deposits from Venezuela, transfers to known sanctioned wallets, or cash withdrawals tied to oil sector employees.Why This Is Different From Russia or Iran

Other sanctioned countries use crypto too. Russia started experimenting after 2022. Iran uses it for oil sales. But Venezuela’s approach is unique. It’s not just individuals or companies dodging rules. It’s the entire state building a parallel financial system - with exchanges, oil deals, and legal frameworks designed for evasion. Russia still uses traditional banking workarounds. Venezuela replaced them. It didn’t just find a loophole. It built a new system from scratch. And it’s working - at least for now. While the U.S. sanctions froze billions in Venezuelan assets, crypto flows kept the regime alive. Oil still leaves the country. Government officials still get paid. And the economy? It’s not thriving, but it’s not dead.

The Human Cost and the Hidden Beneficiaries

For ordinary Venezuelans, crypto is survival. Many rely on Bitcoin and USDT to buy medicine, send money to family abroad, or pay for internet access. Reddit threads and local forums are full of stories: "I saved my life with $50 in crypto," or "My daughter’s insulin came from a crypto transfer." But the same system that saves lives also funds repression. The regime uses crypto to pay military units, buy weapons, and launder money through Hezbollah-linked networks. Israeli intelligence has tracked USDT flows from Venezuela to Hezbollah operatives in Latin America. The Wilson Center calls it "a critical instrument for the regime to launder its most valuable natural resource: oil." There’s no clean side here. Crypto is both a lifeline and a weapon.What’s Next? More Privacy, More Risk

As blockchain analysis tools get better - tools like Chainalysis and Elliptic - the regime is adapting. There are signs they’re moving toward privacy coins like Monero and Zcash. They’re testing decentralized finance (DeFi) protocols to move money without centralized exchanges. They’re using mixers and tumblers to break transaction trails. The U.S. Treasury is watching. OFAC has added dozens of crypto wallets to its sanctions list since 2020. In October 2025, it suspended some sanctions after Maduro agreed to elections - but warned it would reinstate them if democracy didn’t hold. That’s the game now: crypto as leverage. The regime uses it to stay in power. The West uses it as a bargaining chip.Can It Last?

Venezuela’s crypto experiment isn’t sustainable long-term. It’s a stopgap. But it’s effective. As long as the world still needs oil, and as long as crypto remains partially anonymous, this system will keep running. The real question isn’t whether it works - it’s who pays the price. For the average Venezuelan, crypto means food on the table. For the regime, it means staying in control. For global banks and regulators, it’s a warning: when traditional finance fails, crypto doesn’t just fill the gap - it becomes the battlefield.Is it legal to use crypto in Venezuela?

Yes, using cryptocurrency is legal in Venezuela - even encouraged by the government. The state runs its own exchanges and promotes crypto adoption. But sending or receiving crypto from U.S. or EU-based entities may violate sanctions. For ordinary citizens, using Bitcoin to buy groceries is not targeted. For businesses tied to the regime or oil exports, it’s a legal risk.

Can I send crypto to someone in Venezuela?

You can, but it’s risky. If you’re sending USDT or Bitcoin to a personal wallet for family support, it’s unlikely to be blocked. But if the recipient is linked to government entities, state-owned exchanges, or oil companies, your transaction could be flagged. Many U.S. crypto platforms now block Venezuelan addresses entirely to avoid compliance violations.

Why does Venezuela use USDT instead of Bitcoin?

Bitcoin’s price swings too much for daily use. USDT is pegged to the U.S. dollar, so it acts like cash. When a Venezuelan needs to buy medicine or pay rent, they want stability - not a 20% drop overnight. USDT also works better for large oil deals because its value is predictable. Bitcoin is used for savings. USDT is used for survival.

Has the U.S. stopped Venezuela’s crypto sanctions evasion?

No. The U.S. has cracked down - indicting Russian intermediaries, freezing wallets, and blocking exchanges. But the system adapts. New wallets appear. New brokers open. The oil keeps flowing. As long as Venezuela controls its own crypto infrastructure and has international partners willing to help, sanctions evasion continues. Enforcement slows it down, but doesn’t stop it.

Are other countries copying Venezuela’s model?

Yes. Russia explored state-backed crypto after 2022. Iran uses crypto for oil exports. North Korea has hacked crypto exchanges to fund its weapons program. But none have built as comprehensive a system as Venezuela. It’s the only country where crypto isn’t just a workaround - it’s official economic policy. Others are watching. Some may follow.

Kevin Johnston

October 30, 2025 AT 16:02Olav Hans-Ols

October 30, 2025 AT 21:53Dr. Monica Ellis-Blied

November 1, 2025 AT 11:44Herbert Ruiz

November 2, 2025 AT 01:16Saurav Deshpande

November 2, 2025 AT 11:16Paul Lyman

November 2, 2025 AT 11:50Frech Patz

November 3, 2025 AT 06:49Derajanique Mckinney

November 3, 2025 AT 14:49Rosanna Gulisano

November 4, 2025 AT 11:03Sheetal Tolambe

November 6, 2025 AT 04:02gurmukh bhambra

November 7, 2025 AT 03:32Sunny Kashyap

November 7, 2025 AT 18:04james mason

November 7, 2025 AT 20:42Anna Mitchell

November 8, 2025 AT 00:17Pranav Shimpi

November 8, 2025 AT 16:13jummy santh

November 9, 2025 AT 04:34Kirsten McCallum

November 9, 2025 AT 14:15Henry Gómez Lascarro

November 9, 2025 AT 16:48Will Barnwell

November 11, 2025 AT 03:31Lawrence rajini

November 12, 2025 AT 08:54