Nigeria Crypto Tax Calculator

Calculate Your Crypto Tax Liability

Under Nigeria's new tax laws effective 2026, capital gains from cryptocurrency sales must be reported. This calculator estimates your potential tax liability based on current regulations.

Enter your transaction details to see estimated tax calculations

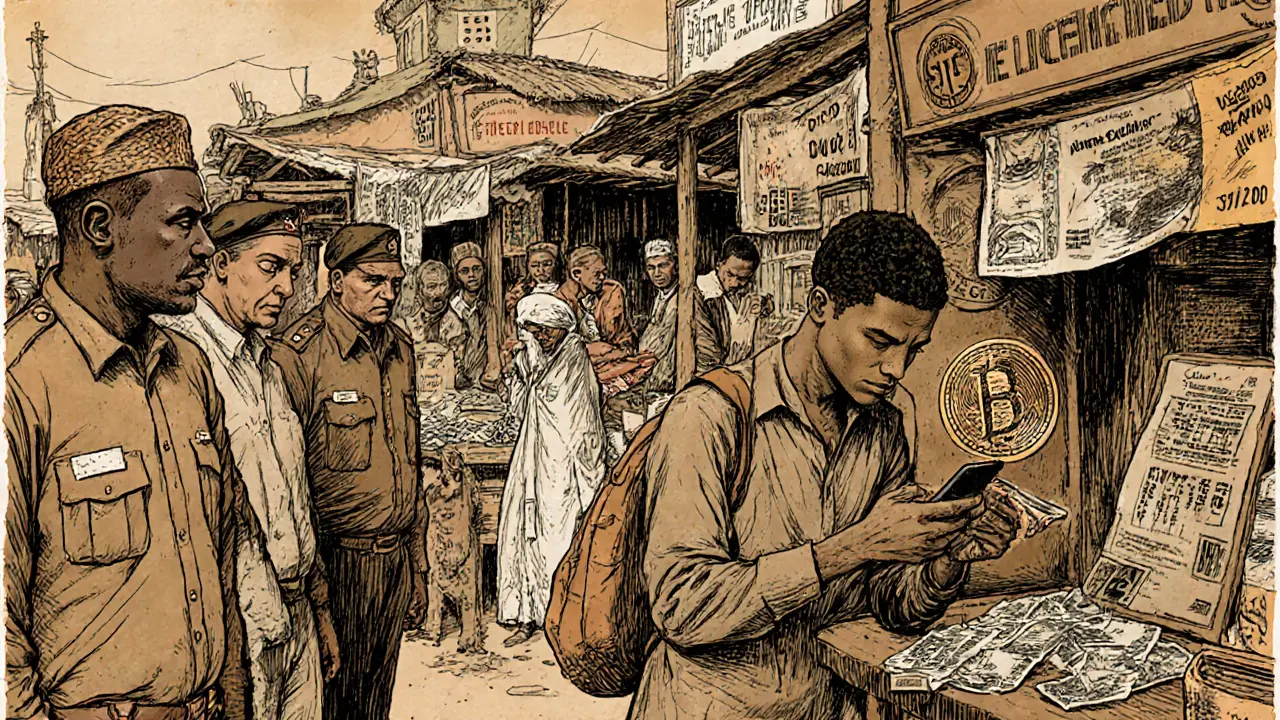

Before 2025, if you asked someone in Nigeria whether cryptocurrency was legal, you’d get a shrug. Some said yes because they traded Bitcoin daily. Others said no because their bank blocked crypto transactions. The truth? It was a gray zone-neither fully banned nor officially allowed. That changed on March 25, 2025, when President Bola Ahmed Tinubu signed the Investments and Securities Act (ISA 2025) into law. For the first time, Nigeria gave digital assets a clear legal standing.

Cryptocurrency Is Not Illegal-But It’s Not Money Either

You can still buy, sell, and hold Bitcoin, Ethereum, and other cryptocurrencies in Nigeria. There’s no law saying you’ll go to jail for owning crypto. But here’s the catch: it’s not legal tender. You can’t use it to pay your electricity bill, buy fuel at a gas station, or settle a government contract. The Nigerian naira is the only currency the state accepts for official transactions. The ISA 2025 defines crypto assets as "a digital representation of value that can be transferred, digitally traded and used for payment or investment purposes." That’s important. It doesn’t call crypto money. It calls it an investment. That distinction matters. It means crypto is now treated like stocks or bonds-not cash. This change didn’t come out of nowhere. Nigeria has been the world’s top country for peer-to-peer (P2P) crypto trading for years. Even after the Central Bank of Nigeria (CBN) banned banks from handling crypto transactions in 2021, people kept trading. They used mobile wallets, P2P platforms, and offshore accounts. The government couldn’t stop it. So in 2025, they decided to regulate it instead.The SEC Is Now in Charge

The Securities and Exchange Commission (SEC) became the main regulator for all crypto activities under the ISA 2025. That means every exchange, wallet provider, or platform offering crypto trading must register with the SEC. Early applicants like Quidax and Busha have already been approved, but many others are still waiting. The process is slow because the SEC is doing deep background checks-on company ownership, security systems, and anti-fraud controls. The SEC now has powers no one had before. They can:- Audit crypto platforms at any time

- Suspend operations if they spot illegal activity

- Remove executives from their jobs

- Impose fines up to billions of naira

Multi-Agency Oversight: Who’s Really Watching?

Crypto regulation in Nigeria isn’t just the SEC’s job anymore. A new team of agencies now works together:- SEC - regulates crypto as a security, licenses exchanges

- Central Bank of Nigeria (CBN) - controls banking rules, ensures crypto doesn’t destabilize the naira

- Economic and Financial Crimes Commission (EFCC) - investigates fraud, money laundering, and scams

- Nigerian Financial Intelligence Unit (NFIU) - tracks suspicious transactions for AML/CFT compliance

Taxes Are Coming-And They’re Strict

In June 2025, Nigeria passed the Nigeria Tax Administration Act (NTAA 2025). It takes effect in 2026, but crypto users need to prepare now. Virtual Asset Service Providers (VASPs)-that’s exchanges, wallet apps, and trading platforms-must collect and report taxes on behalf of users. If they don’t, they face heavy penalties:- ₦10 million ($6,693) for the first month of non-compliance

- ₦1 million ($669) for every extra month after that

Why This Matters for Everyday Nigerians

For most people, this isn’t about laws. It’s about safety. Before 2025, if you lost money in a crypto scam, there was no one to complain to. Now, if a platform you use gets shut down for fraud, the SEC is legally required to help you recover your funds-or at least investigate why it happened. It also means you can finally open a bank account if you run a crypto business. In 2021, banks refused to work with crypto startups. Now, as long as you’re licensed by the SEC, banks must serve you. That’s huge for entrepreneurs. Even fintech apps like PiggyVest, Cowrywise, and Bamboo-once operating in legal gray areas-are now under clear rules. They can offer higher returns than banks by investing in government bonds or foreign stocks, but only if they follow SEC guidelines. That protects users who thought they were saving money but were actually risking it on unregulated platforms.Challenges Still Remain

The law is clear-but implementation is messy. Many small crypto businesses are still waiting for their licenses. The SEC has a backlog. Some platforms are shutting down temporarily because they can’t meet the new compliance costs. Others are moving operations offshore to avoid the paperwork. Also, the law doesn’t cover everything. What about decentralized exchanges (DEXs)? What if you trade crypto directly from your wallet without using a Nigerian platform? The SEC can’t regulate those easily. That’s a loophole-and it’s being watched. Local governments trying to raise money through bonds or promissory notes now have to follow new rules too. They can’t borrow more than 50% of their expected revenue. That’s meant to prevent debt crises. But it also means fewer public projects funded through crypto-backed bonds-at least for now.What’s Next?

Nigeria’s approach is becoming a model for Africa. Countries like Kenya, Ghana, and South Africa are watching closely. If Nigeria’s system works-keeping fraud low while encouraging innovation-it could be copied. The future of crypto in Nigeria won’t be wild and unregulated. It won’t be dead either. It will be controlled. Licensed. Taxed. And monitored. For users, that means less risk. For traders, it means more rules. But for the first time, there’s a path forward that’s legal, safe, and clear.Is cryptocurrency legal in Nigeria in 2025?

Yes, cryptocurrency is legal in Nigeria as of 2025 under the Investments and Securities Act (ISA 2025). It is recognized as a digital asset and regulated as a security, but it is not legal tender. You can buy, sell, and hold crypto, but you cannot use it to pay for goods or services where the naira is required.

Can I open a bank account for my crypto business in Nigeria?

Yes, if your crypto business is licensed by the Securities and Exchange Commission (SEC). The Central Bank of Nigeria (CBN) now permits banks to provide accounts to registered Virtual Asset Service Providers (VASPs). This was not allowed before 2023 and became fully operational under the ISA 2025.

Do I have to pay taxes on my crypto profits in Nigeria?

Yes, starting in 2026, the Nigeria Tax Administration Act (NTAA 2025) requires Virtual Asset Service Providers (VASPs) to collect and report taxes on crypto transactions. Individuals must declare capital gains from crypto sales, and failure to comply could lead to penalties or legal action. The SEC can suspend or revoke licenses of non-compliant platforms.

Are NFTs regulated in Nigeria?

Only investment-focused NFTs are regulated. If an NFT is marketed as a financial product-like a share in future earnings or a revenue-sharing asset-it falls under SEC oversight. Artistic or collectible NFTs, such as digital art or music, are not regulated unless they’re sold as investment opportunities.

What happens if a crypto exchange gets shut down in Nigeria?

If a licensed exchange violates regulations, the SEC can suspend or revoke its license. Users may be able to file claims through regulatory channels, and the EFCC may investigate if fraud is involved. The law now requires exchanges to keep user funds segregated and maintain audit trails, improving the chances of recovery.

Can I trade crypto on decentralized platforms like Uniswap from Nigeria?

Yes, you can use decentralized exchanges (DEXs) like Uniswap from Nigeria. However, these platforms are not regulated by Nigerian authorities, so you have no legal protection if something goes wrong. The SEC’s jurisdiction only applies to Nigerian-based or registered VASPs. Trading on DEXs remains a personal risk.

Why did Nigeria change its crypto laws so drastically in 2025?

Nigeria became the world’s largest P2P crypto market despite the 2021 banking ban. With $92.1 billion in crypto inflows in just one year, the government realized it couldn’t ignore the trend. The ISA 2025 was designed to bring order to chaos-protecting users, taxing income, stopping fraud, and allowing legitimate businesses to operate without fear of sudden crackdowns.

Andrew Morgan

October 28, 2025 AT 22:11Man I saw this coming for years

Everyone in Nigeria was already trading crypto like it was cash

Now the government just slapped a label on it and called it regulation

Kinda wild how they couldn't stop it so they just started taking a cut

At least now you got someone to blame when things go south

Michael Folorunsho

October 29, 2025 AT 13:15Let me guess-this is just another case of a third-world nation trying to mimic Western financial systems without understanding them

Calling crypto an 'investment' doesn't make it one

It's digital speculation wrapped in bureaucratic jargon

And now they're taxing it? Please

Real economies don't need to regulate memes and blockchain noise

Roxanne Maxwell

October 31, 2025 AT 01:27I love how Nigeria turned a chaotic situation into something actually structured

People were already using crypto to survive-paying bills, sending remittances, starting businesses

Instead of fighting it, they leaned in

That’s real leadership

Even if it’s messy, at least now there’s a path forward

Hope other African countries take notes

Jonathan Tanguay

November 1, 2025 AT 10:11Okay so let me get this straight the SEC now has power to audit remove executives and fine up to billions of naira but they cant regulate decentralized exchanges that are literally outside their jurisdiction

That’s like having a police force that can arrest you for speeding but not for driving a car without a license

And the tax law kicks in in 2026 but VASPs have to comply now

That’s not regulation that’s extortion with paperwork

Also why are they calling NFTs investment vehicles when most are just JPEGs

And who decided that the CBN and EFCC need to be involved in this

Are we running a country or a spy thriller

Ayanda Ndoni

November 3, 2025 AT 01:56So now I gotta pay taxes on crypto but my electricity bill still only takes naira

Great

So I make money in crypto but I can’t use it to buy anything real

And now I gotta deal with SEC audits and bank compliance

Why did they even bother

Why not just legalize it as money like El Salvador

Now I’m stuck paying taxes on digital ghosts

Elliott Algarin

November 4, 2025 AT 14:20There’s something poetic about a nation that defied a banking ban for years only to have its underground economy formalized by law

It’s not about control

It’s about recognition

People didn’t wait for permission to innovate

They just did it

And now the state is finally acknowledging what was already real

Maybe regulation isn’t the end of freedom

Maybe it’s just the beginning of responsibility

John Murphy

November 6, 2025 AT 07:52Interesting how the SEC is treating crypto like stocks but not like money

That’s actually smart

Because if it were money you’d have inflation issues and currency collapse

But as an asset it can be taxed and tracked

Still wonder how they’ll handle private wallet trades

And why the tax law starts in 2026 but compliance is required now

That’s gonna cause chaos

Zach Crandall

November 7, 2025 AT 07:05While I appreciate the structural clarity introduced by the ISA 2025, I must express concern regarding the institutional overreach implied by multi-agency coordination

The convergence of SEC, CBN, EFCC, and NFIU creates a regulatory labyrinth that may stifle innovation under the guise of compliance

Furthermore, the imposition of taxation without concurrent fiscal infrastructure development raises questions of equity and administrative feasibility

One must question whether this is progress-or merely the institutionalization of surveillance

Akinyemi Akindele Winner

November 7, 2025 AT 11:08Na so this be the government’s version of 'I dey see you' with a license form

They tried to kill crypto with bank ban but people dey trade like na Sunday market

Now they come with SEC and tax and all that nonsense

But let me tell you something

They don’t own the blockchain

They don’t own the wallet

They don’t own the internet

So if you think this law change anything for the real traders

Abeg, go sleep

We still dey trade

And we still dey win

Patrick De Leon

November 8, 2025 AT 21:33Regulation is just a fancy word for control

And control is just a step before confiscation

They say they want to stop fraud but they’re just making it harder for ordinary people to escape inflation

This isn’t progress

This is surrender to the old system

And now they want to tax your freedom

Pathetic

MANGESH NEEL

November 10, 2025 AT 16:49Oh wow Nigeria finally got smart

Wait no they didn’t

They just copied the US regulatory mess and called it innovation

Taxing crypto is like taxing air

People use it because banks are broken

And now they want to audit your wallet

And punish platforms for not being perfect

Meanwhile the real criminals are in the government

And they’re the ones writing the rules

This is not regulation

This is a trap for the poor who dared to think outside the system

Sean Huang

November 10, 2025 AT 23:27They say this is about protecting users

But who’s protecting us from the regulators

Think about it

What if the SEC gets hacked

What if the EFCC starts using crypto data to target dissidents

What if the tax system gets weaponized

And what if this is all just the first step to a national digital currency

That tracks every transaction

That bans privacy

That makes you pay for your own freedom

They’re not regulating crypto

They’re building the surveillance state

And we’re all just rats in their experiment

Wake up

They’re coming for your wallet next

Ali Korkor

November 11, 2025 AT 02:15This is actually a win

Before you had no recourse if you got scammed

Now you can file a complaint and someone has to look

And banks finally have to work with legit crypto businesses

Yeah it’s not perfect

But it’s a start

Keep learning

Keep trading

But do it smart

You got rules now-use them to protect yourself

madhu belavadi

November 13, 2025 AT 01:48They’re taxing crypto but not fixing the power grid

They’re regulating wallets but not fixing corruption

So what’s the point

I’m just waiting for the next scam to blow up

And then they’ll blame the users again

Dick Lane

November 14, 2025 AT 19:35Man I’ve been holding BTC since 2020 and never thought I’d see this day

Used to get my account frozen every time I tried to move crypto

Now I can actually open a business account

Not perfect

But it’s better than nothing

Hope they don’t mess it up with too many rules

Norman Woo

November 16, 2025 AT 18:01Decentralized exchanges are still a loophole

And the government knows it

But they’re pretending they can control everything

Meanwhile I’m still using Phantom and Metamask

And they can’t touch me

They can regulate platforms

But they can’t regulate code

And they sure as hell can’t regulate me

Serena Dean

November 18, 2025 AT 00:12If you’re running a crypto business in Nigeria-get licensed

It’s not scary

It’s just paperwork

And once you’re approved, banks can’t refuse you anymore

That’s huge

And yes you gotta pay taxes

But now you’re playing in the real game

Not the wild west

And you’ve got legal protection

That’s worth the effort

James Young

November 19, 2025 AT 19:40Let’s be real-the SEC doesn’t have the resources to audit every platform

And the tax system is going to collapse under its own weight

This is all theater

They want the money

They want the control

But they don’t have the competence to enforce it

So they’ll pick a few big targets

And the rest of us will keep trading like before

Just a little quieter