Leverage Risk Calculator

Risk Calculator

Important Information

Remember: MGBX offers up to 200x leverage which means:

- 0.5% price movement against you = 100% position loss at 200x

- No regulatory protection or insurance backing

- Withdrawals under $100,000 don't require KYC

- Not suitable for beginners or long-term holdings

Imagine trading crypto with MGBX-no ID, no waiting, and leverage up to 200x. Sounds like a dream? Maybe. But here’s the real talk: this platform isn’t for everyone. It’s built for traders who want speed, privacy, and extreme risk in one click. And if you’re looking for a safe, regulated place to hold your Bitcoin? Keep looking.

What Is MGBX, Really?

MGBX isn’t new. It’s the rebranded version of Megabit, a crypto exchange that started back in 2019. In early 2025, they dropped the old name, upgraded their app, and relaunched as MGBX. The goal? To be the go-to for traders who hate paperwork and love high-risk, high-reward moves.

It supports over 136 coins, including Bitcoin, Ethereum, Solana, and Dogecoin. You can trade spot pairs like BTC/USDT or jump into futures with 200x leverage. That’s not a typo. Most exchanges cap leverage at 100x. MGBX goes double. And yes, you can trade with USDT or actual crypto as collateral.

The platform also offers copy trading, where you mirror the trades of top performers. There’s a peer-to-peer (C2C) section for buying crypto with fiat, and a referral program that pays you for bringing in new users. It even has an "experience fund"-a demo account where you trade with virtual money and can withdraw a portion of your profits. It’s like a training ground with real rewards.

No KYC? Here’s What That Actually Means

MGBX doesn’t require KYC for basic trading. That means you can sign up, deposit crypto, and start trading without submitting a passport or selfie. Withdrawals under $100,000 don’t need verification either. This is huge for users in countries with strict crypto rules-or for anyone who just wants to stay off the radar.

But here’s the catch: no KYC also means no protection. If your account gets hacked, there’s no customer support team that can verify it’s you. If you get scammed, there’s no chargeback. Regulated exchanges like Binance or Coinbase have insurance and dispute processes. MGBX doesn’t. You’re on your own.

It’s also why MGBX blocks users from the U.S. and Hong Kong. Those regions have strict anti-money laundering laws. If you’re trying to use a VPN to get around that? You’re violating their terms. And if they catch you, your funds could vanish without warning.

Security: Insurance, Cold Storage, and the Missing License

MGBX claims to have $50 million in insurance coverage and uses cold storage for most user funds. That sounds solid-until you dig deeper. The insurance policy isn’t backed by a known insurer like Lloyd’s of London. It’s likely a self-insured pool, which means if too many users lose funds at once, the system could collapse.

They use SSL encryption, which is standard. Their website passes DNSFilter checks. Scamadviser gives them a "relatively high" legitimacy score. But here’s the problem: they have no official license from any financial authority. Not from the U.S., not from the EU, not even from the Cayman Islands or Malta-places where many crypto firms register.

This isn’t just a technicality. It means MGBX operates in a legal gray zone. If regulators crack down on unlicensed high-leverage exchanges, MGBX could shut down overnight. And if that happens? Your crypto could disappear with no legal recourse.

Trading Features: Fast, But Dangerous

The platform’s trading engine is built for speed. Orders execute in milliseconds. That’s great during volatile markets when a 0.5-second delay can cost you thousands.

The futures market supports both cross-margin and isolated margin. Cross-margin uses your whole account balance as collateral, which can be risky. Isolated margin limits risk to one position-better for beginners.

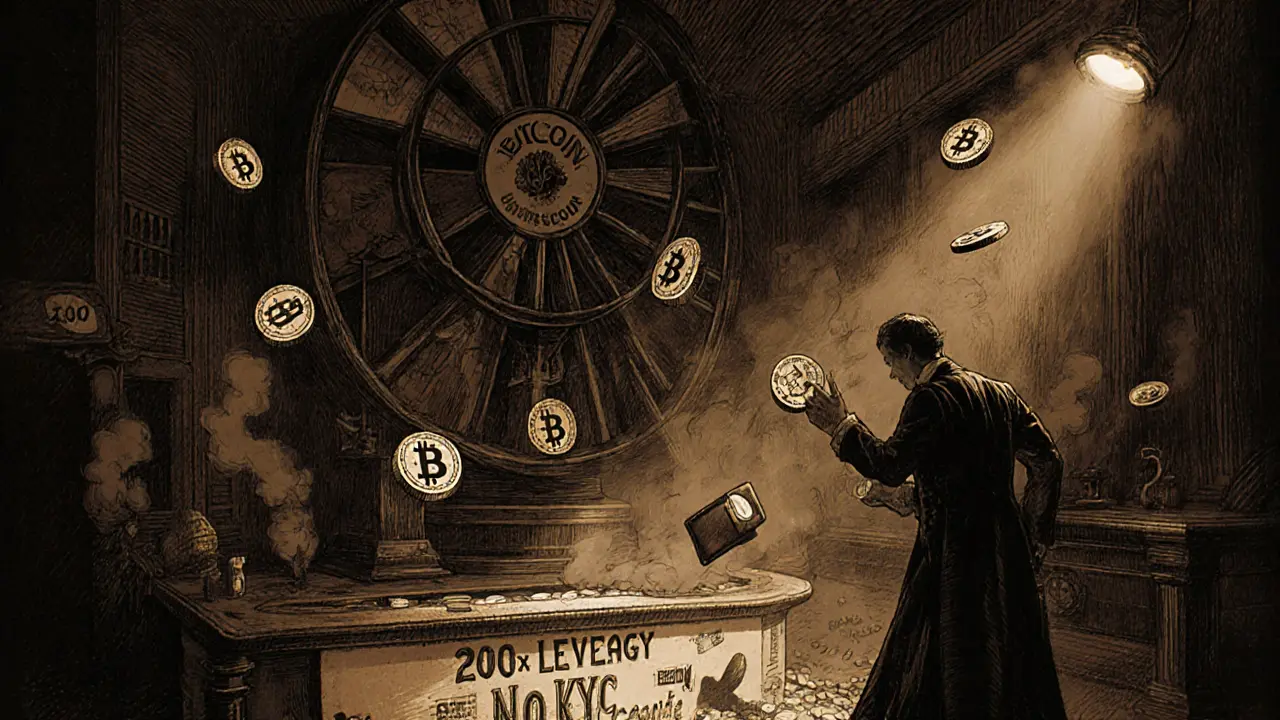

Auto-deleverage kicks in if your position is at risk of liquidation. It’s designed to protect the platform’s liquidity, not you. And with 200x leverage, liquidation isn’t rare. It’s common. One wrong move, and your entire position vanishes. Traders who use this leverage without stop-losses are playing Russian roulette with their crypto.

Copy trading sounds like a shortcut to profits. But here’s the truth: the top traders you copy are often running high-risk strategies. If they lose, you lose. And you won’t know how much risk they’re taking until it’s too late.

Fees: Too Good to Be True?

This is where things get messy. Some sources say MGBX charges 0.1% for spot trading. Others claim maker and taker fees are 0.00%. Which is it?

There’s no clear fee schedule on their website. That’s a red flag. Legit exchanges list fees upfront. If you can’t find them, they might change them anytime. And hidden fees? They’re the first thing unregulated platforms use to eat your profits.

For futures trading, there’s no mention of funding rates. Those can add up fast on long positions. And withdrawal fees? Not listed. You might think you’re getting free trades, only to get hit with a $50 fee when you try to cash out.

Performance and Traffic: A Quiet Player

MGBX isn’t Binance. It’s not even Kraken. According to traffic data, it gets about 1,600 visits a month-less than 0.3% of Binance’s traffic. It ranks 439th out of 612 crypto exchanges. That’s not a bad number for a startup, but it’s not a sign of mass adoption.

The bounce rate is 36%, which is decent. People stay for about 1 minute and 6 seconds. That’s enough to check prices and place a trade, but not enough to explore features. The iOS app has only 4 reviews. One user said: "Trading is still very smooth, more other cryptocurrencies would be even better." That’s not glowing. It’s polite.

They joined Token2049 Dubai in May 2025-good for visibility. But they don’t have active Reddit communities, Twitter threads, or YouTube tutorials. There’s no buzz. That’s not a sign of a thriving platform. It’s a sign of a niche tool for a small group of traders.

Who Should Use MGBX?

MGBX isn’t for beginners. It’s not for long-term holders. It’s not for people who want to sleep at night.

It’s for experienced traders who:

- Understand how 200x leverage works-and the math behind liquidation

- Don’t mind trading without KYC and accept the risks

- Use stop-losses religiously

- Only risk money they can afford to lose

- Are outside the U.S. and Hong Kong

If you’re looking for a safe place to buy Bitcoin and hold it for years? Use Coinbase or Kraken. If you want to trade derivatives with high leverage and don’t care about regulation? MGBX might be your tool.

The Bottom Line

MGBX is a powerful, fast, and unregulated exchange built for a specific kind of trader. It offers features most platforms don’t-especially 200x leverage and no KYC. But those features come with massive risks.

There’s no safety net. No insurance you can trust. No legal recourse. And if the market turns, or regulators move, MGBX could vanish without a trace.

If you decide to try it: start small. Use isolated margin. Set stop-losses. Never put in more than you’re willing to lose. And never, ever trust the "experience fund" as a real profit source-it’s a marketing tool, not a financial product.

MGBX isn’t a scam. But it’s not a bank. It’s a casino with crypto chips. And in a casino, the house always has the edge.

Is MGBX safe to use?

MGBX uses SSL encryption and cold storage, and it has a $50 million insurance claim-but that insurance isn’t backed by a recognized insurer. There’s no government license, no regulatory oversight, and no customer support for account recovery. It’s safe from a technical standpoint, but not from a legal or financial one. Treat it like a high-risk trading tool, not a secure wallet.

Can I withdraw my crypto without ID?

Yes, you can withdraw up to $100,000 worth of crypto without verifying your identity. But if you try to withdraw more, or if the platform flags your activity as suspicious, they may freeze your account and ask for KYC. This is common on unregulated exchanges. Don’t assume anonymity is permanent.

Is 200x leverage really usable?

Technically, yes. But it’s extremely dangerous. With 200x leverage, a 0.5% price move against you can wipe out your entire position. Most professional traders use 5x to 10x. Even 20x is considered aggressive. 200x is for gambling, not trading. Only use it if you fully understand liquidation risk and have strict stop-losses in place.

Why is MGBX banned in the U.S. and Hong Kong?

Both regions have strict anti-money laundering and consumer protection laws. MGBX’s no-KYC policy and 200x leverage violate those rules. The exchange blocks users from these areas to avoid legal action. If you use a VPN to access MGBX from these regions, you’re violating their terms-and you won’t get help if something goes wrong.

Does MGBX have a mobile app?

Yes, MGBX has an iOS app called "MGBX: Buy Bitcoin & Crypto" (App Store ID 6737500828). It’s available in most countries outside the U.S. and Hong Kong. The Android version isn’t listed on Google Play, so you’d need to download it directly from their website-which carries security risks. Always verify the app’s authenticity before installing.

Are the trading fees really 0%?

There’s conflicting information. Some sources say fees are 0.1%, others claim 0.00%. MGBX doesn’t publish a clear fee schedule. This lack of transparency is a red flag. You might think you’re getting free trades, only to be hit with hidden withdrawal fees or funding rates on futures. Always check your trade confirmations carefully.

Can I use MGBX for long-term investing?

Not recommended. MGBX is built for active trading, not holding. It lacks features like staking, savings accounts, or secure cold wallet integration. Your crypto is stored on the exchange, which means you don’t control the private keys. If the platform shuts down or gets hacked, your long-term holdings could be lost. Use a hardware wallet like Ledger or Trezor for long-term storage.

bob marley

November 2, 2025 AT 08:25200x leverage? Bro, you’re not trading-you’re renting a rollercoaster with no seatbelts and betting your life savings on which loop kills you first.

Jeremy Jaramillo

November 3, 2025 AT 22:42I’ve seen too many people get crushed by platforms like this. The no-KYC thing sounds cool until you realize you’re the only one responsible for every mistake. If you’re going to trade high-leverage, at least use isolated margin and set stop-losses like your life depends on it-because it does.

Sammy Krigs

November 4, 2025 AT 00:47wait so they dont even have a clear fee scheudle?? that’s wild. i thought the 0% thing was a joke but now im not sure if they’re just lazy or scamming. also why is the android app not on play store?? that’s a red flag bigger than my ex’s last text.

David Roberts

November 5, 2025 AT 21:29The absence of regulatory licensing isn’t merely a technicality-it’s an ontological void in the platform’s legitimacy. Without oversight, the $50M insurance claim becomes a performative artifact, a symbolic gesture designed to simulate security in the absence of institutional trust. The platform operates in a post-regulatory episteme where risk is commodified and accountability is an afterthought. One must ask: is this innovation or institutional decay dressed in blockchain?

Monty Tran

November 6, 2025 AT 20:41200x leverage is not a feature it is a suicide pact wrapped in a trading interface

Beth Devine

November 7, 2025 AT 22:13If you’re new to crypto and thinking about trying this, just pause. Take a breath. Go use a regulated exchange first. Learn how margin works. Learn what liquidation really means. Then come back. This isn’t the place to learn-it’s the place you learn the hard way.

Brian McElfresh

November 8, 2025 AT 03:40They’re using cold storage? Sure. But did you know the ‘insurance’ is probably just a pool of user deposits? That’s how these unregulated platforms work-they use your money to pay off other users’ wins until the whole thing collapses. And then what? They disappear. Maybe they’re already working with intelligence agencies to track who’s using it. Maybe your IP is already flagged. Maybe you’re already on a list.

Hanna Kruizinga

November 9, 2025 AT 06:23So basically it’s a crypto casino that doesn’t even bother to pretend it’s not one? Cool. I’ll stick with my Coinbase wallet and my sleep schedule. Also, the iOS app has four reviews? One of them says ‘more coins would be better’? That’s not a review, that’s a polite shrug.

David James

November 10, 2025 AT 21:46if you are thinking about using this make sure you only put in what you can afford to lose. dont be that guy who loses everything because he thought he could beat the system. just be smart. trade small. use stop losses. and never trust the demo account to be real profit

Shaunn Graves

November 12, 2025 AT 11:13Why are people still falling for this? The lack of transparency in fees alone should be a dealbreaker. No one in their right mind runs a legitimate business without publishing their fee structure. This isn’t ‘edgy’-it’s predatory. And the fact that they block the U.S. and Hong Kong? That’s not a feature. That’s a confession.

Jessica Hulst

November 13, 2025 AT 16:11There’s something deeply ironic about trading on a platform that offers freedom from identity-while simultaneously stripping you of any real safety net. We fetishize anonymity in crypto, but we forget that freedom without responsibility is just chaos with a UI. MGBX doesn’t care if you win or lose. It only cares that you keep playing. And the house? The house always wins-even when it’s not technically the house, because it’s just a server in a basement somewhere with no license, no accountability, and no conscience.

Kaela Coren

November 15, 2025 AT 12:08Statistical analysis of user engagement metrics suggests minimal long-term retention. The average visit duration of 66 seconds indicates transactional behavior rather than platform loyalty. The absence of community-driven content (Reddit, YouTube, Twitter) further supports the hypothesis that MGBX serves a transient, high-risk user cohort rather than a sustainable ecosystem. This is not a platform-it is a transient liquidity sink.

Nabil ben Salah Nasri

November 17, 2025 AT 08:59bro i love the idea of no KYC but please please please use a hardware wallet to withdraw. and if you’re copy trading, check the history-not just the profit graph. i saw one guy with 1000% ROI and he had 12 liquidations in 3 weeks. he’s not a guru-he’s a time bomb. and yes, i’ve used MGBX. i only trade 0.5% of my portfolio there. always. 🙏

alvin Bachtiar

November 18, 2025 AT 23:26This platform is a goddamn neon-lit venus flytrap with a 200x jaws-to-soul ratio. They don’t want traders-they want cannon fodder. The ‘experience fund’? That’s the bait. The 200x leverage? The trap. The no-KYC? The cover-up. And the silent fee structure? The final bite. You think you’re outsmarting the system? Nah. You’re just the meat in their grinder. And when you’re gone? They’ll just roll out a new banner and wait for the next sucker.

Josh Serum

November 20, 2025 AT 22:37look if you're smart enough to understand leverage and you're not trying to get rich quick then go for it. but if you're reading this and thinking 'i can flip 1000 into 100k' then please just stop. go get a job. or invest in btc. anything but this. you're not a trader. you're a gambler. and this casino doesn't even have a bathroom.

DeeDee Kallam

November 22, 2025 AT 03:15i just lost my entire life savings on this thing and now im crying in my car and my cat is judging me and i dont even know if theyre still open or if my money is gone forever