BRG Crypto Risk Calculator

Investment Risk Assessment

Enter your investment details to see if Bridge AI (BRG) is suitable for your portfolio based on verified metrics from the article.

Risk Assessment Results

- Liquidity: Daily volume of $125,993 (LBank) - High risk of price manipulation

- Development: Last commit March 2024 - No active development

- Utility: No working products - No real token utility

- Community: 1,247 Twitter followers - Minimal engagement

- Regulatory: Potential SEC classification as security - Regulatory risk

Bridge AI (BRG) isn’t another meme coin. It claims to be something more - a blockchain project that uses artificial intelligence to make Web3 smarter, safer, and more automated. But here’s the truth: if you’re looking at BRG as an investment, you’re stepping into one of the riskiest corners of the crypto market. This isn’t about hype. It’s about what’s actually happening with this token right now - and why most experts warn against it.

What Bridge AI (BRG) actually does

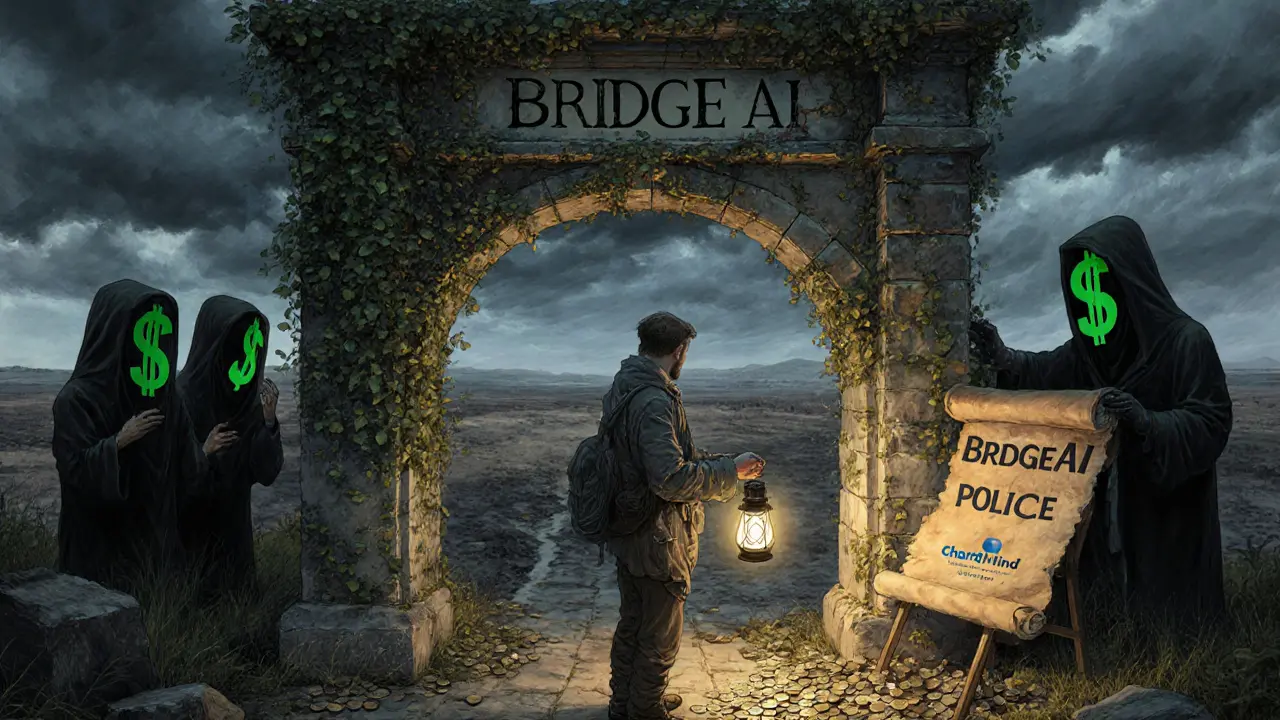

Bridge AI, originally called Bridge Oracle, says it’s building tools to connect AI with blockchain. Its two main products are BridgeAI Police and ChartMind. BridgeAI Police is supposed to scan DeFi protocols and warn users about scams. ChartMind claims to give advanced trading signals using AI analysis. Sounds useful, right? The problem is, no one can actually use them. You won’t find working demos. No public API access. No open-source code showing how these tools function. The official website, bridge.link, has an 8-page whitepaper that reads like a marketing pitch - no technical details, no architecture diagrams, no code examples. Developers who reached out for ChartMind’s API documentation got no replies after two weeks. That’s not a startup struggling to launch. That’s a project stuck in perpetual beta with no signs of progress.Token supply and market data

Bridge AI has a total supply of 10 billion BRG tokens. About 8 billion are in circulation. That sounds big - until you look at the price. As of October 2025, BRG trades around $0.0001662. That gives it a market cap of roughly $1.3 million to $3.1 million, depending on which exchange you check. For comparison, Fetch.ai, another AI-blockchain project, has a market cap over $1 billion. Bridge AI is less than 0.1% of that size. Trading volume is a red flag. CoinGecko reports a 24-hour volume of $187,951. CoinMarketCap says $749,470. That’s a 400% difference - a sign that data is unreliable or manipulated. On LBank, the BRG/USDT pair has only $125,993 in daily volume. That’s not liquidity. That’s a graveyard for traders. One user on CoinGecko described trying to sell 1 million BRG tokens. The price dropped 22% during the transaction. That’s not normal market movement. That’s slippage caused by thin order books - a classic sign of low demand and high manipulation risk.Where BRG is listed - and where it’s not

Bridge AI is listed on only four major exchanges: Bitget, LBank, Gate.io, and MEXC. That’s it. No Coinbase. No Binance. No Kraken. No KuCoin. That’s not accidental. Major exchanges have strict listing standards. They check for team transparency, code activity, liquidity, and legal compliance. Bridge AI doesn’t meet any of those. It runs on Ethereum and Binance Smart Chain, so technically, you can hold it in MetaMask or Trust Wallet. But holding it doesn’t mean you can use it. There’s no wallet integration for BridgeAI Police. No dApp to connect to. No smart contract you can interact with beyond buying and selling. It’s a token with no utility - just a ticker symbol.Development activity? Almost none

Check the GitHub repo. The last commit was March 17, 2024. There are only 12 commits total since the project started. That’s not development. That’s maintenance at best. Compare that to Fetch.ai, which pushes dozens of updates per month. Or SingularityNET, which has active developer communities and regular code releases. Bridge AI’s GitHub doesn’t even have a README file explaining how to set up a node or contribute. No issue tracker with open bugs. No roadmap updates. Just silence.

Community and social presence

The project’s Twitter account, @bridge_oracle, has 1,247 followers. Most tweets get 1 or 2 likes. The last post was August 3, 2025. No updates. No announcements. No engagement. Their Telegram group has 427 members. Most are silent. No admins answering questions. No announcements about new features. No AMAs. Just a ghost town. On Reddit, there were only 12 mentions of BRG in the past 90 days. Zero threads with meaningful discussion. On Trustpilot? No reviews. On CoinMarketCap’s user comments? Three neutral reviews saying, “Good idea, but no product.”Price predictions? Don’t believe them

Some sites like CoinCheckup claim BRG could hit $0.0005156 by November 2025 - a 190% increase. But here’s the catch: they also call the market outlook “bearish.” That’s a contradiction. If the market is bearish, how can the price rise 190%? Their model is broken, or they’re trying to create false hope. CoinMarketCap’s AI analysis doesn’t give price targets at all. It just describes what Bridge AI claims to do - neutral, factual, no hype. That’s the most honest take you’ll find.Why this is dangerous

Bridge AI has all the warning signs of a low-cap pump-and-dump coin:- Extremely low liquidity - hard to buy or sell without moving the price

- Minimal development - no code updates for over a year

- No real product - just promises on a website

- Weak community - no engagement, no support

- Concentrated holdings - Etherscan shows only 1,842 wallets hold BRG, but CoinMarketCap claims 59,880 holders. That discrepancy suggests fake or inflated holder counts

Regulatory risk? Possibly

The U.S. SEC’s October 2024 guidance said AI-based tokens that promise automated returns or data services could be classified as securities. Bridge AI hasn’t been targeted yet - but if they ever try to market BRG as an investment tool or revenue-sharing mechanism, regulators could step in. That would freeze trading, delist it from exchanges, and wipe out any remaining value.Is Bridge AI (BRG) worth it?

No. Not for trading. Not for investing. Not for using. If you’re curious about AI and blockchain, there are better projects with real products: Fetch.ai, SingularityNET, Ocean Protocol. They have code, teams, users, and active development. Bridge AI has a token, a website, and a lot of empty promises. The only people making money from BRG are the early holders who dumped their tokens when the price spiked in 2023. Everyone else is holding a digital asset with no real-world function and zero chance of recovery.What to do instead

If you want exposure to AI-blockchain tech, look at projects with:- Active GitHub repositories (100+ commits in the last year)

- Live, working dApps you can test

- Listing on at least 3 major exchanges

- Clear documentation and developer support

- Community engagement (not just bots and paid promoters)

Is Bridge AI (BRG) a good investment?

No. Bridge AI has extremely low liquidity, almost no development activity, no working products, and a market cap under $2 million. Most experts classify it as extremely high risk. The token’s price is easily manipulated, and there’s no evidence of real adoption or utility. Avoid it unless you’re prepared to lose your entire investment.

Where can I buy BRG coin?

BRG is listed on four exchanges: Bitget, LBank, Gate.io, and MEXC. It is not available on major platforms like Binance, Coinbase, or Kraken. Trading volumes are very low, so buying or selling large amounts can cause extreme price swings. Use caution - the market is thin and prone to manipulation.

Does Bridge AI have a working product?

No. Bridge AI claims to have two tools - BridgeAI Police and ChartMind - but neither has a public demo, API access, or user documentation. Developers who contacted support for API details received no replies. The official whitepaper is only 8 pages and lacks technical details. There is no verifiable proof these tools exist beyond marketing claims.

Why is the BRG price so low?

The price is low because there’s almost no demand. With only $125,993 in daily trading volume on LBank and minimal exchange listings, buyers are scarce. The token’s market cap is under $2 million, making it one of the smallest AI-blockchain projects. Low liquidity means even small trades move the price dramatically, which scares off serious investors.

Is Bridge AI regulated?

Bridge AI has not been targeted by regulators like the SEC. However, the SEC’s 2024 guidance classified similar AI-token projects as potential securities if they promise automated returns or data services. If Bridge AI ever markets BRG as an investment tool, it could face regulatory action, leading to delisting and loss of value.

Can I use BRG to access AI tools?

No. There is no functional way to use BRG tokens to access Bridge AI’s claimed AI tools. No dApp, no API, no dashboard, and no documentation. Even if you hold BRG, you cannot interact with any of the services the project promotes. It’s a token with no practical use.

How many people hold BRG tokens?

CoinMarketCap claims 59,880 holders, but Etherscan data shows only 1,842 unique wallet addresses holding BRG. This huge discrepancy suggests the holder count may be inflated - possibly by fake wallets or centralized exchange accounts. Real, active holders are likely in the hundreds, not tens of thousands.

What’s the future of Bridge AI?

The future looks bleak. Development has stalled since March 2024. Social media is inactive. No partnerships, no product launches, no community growth. Without a major overhaul - new code, real tools, and active marketing - BRG will likely fade into obscurity. There are no signs of recovery.

bob marley

November 1, 2025 AT 05:47Oh wow, another ‘AI blockchain revolution’ that’s just a PowerPoint deck with a token attached. I’ve seen this movie before - the only thing being bridged here is your wallet to the dumpster. The fact that their GitHub hasn’t been touched since 2024 says everything. If your ‘product’ is older than my last diet resolution, it’s not a project. It’s a graveyard.

And don’t get me started on the holder count discrepancy. 59k holders? Yeah right. That’s like saying ‘10,000 people watched my YouTube video’ when it’s just your 12 friends and 3 bots.

Save your gas fees. Go buy a coffee. At least that tastes good.

Bridge AI? More like Bridge to Nowhere.

Also, who approved that whitepaper? A middle schooler with a thesaurus and zero coding experience?

Jeremy Jaramillo

November 2, 2025 AT 11:44Thanks for laying this out so clearly. This is exactly the kind of deep-dive analysis that’s missing from most crypto threads. Too many people get sucked in by flashy names and vague promises - ‘AI-powered,’ ‘decentralized,’ ‘next-gen’ - without checking if anything actually works.

It’s not just about the numbers. It’s about the silence. No code updates. No responses to developers. No community engagement. That’s not a startup. That’s a ghost town with a ticker symbol.

And the fact that no major exchange lists it? That’s not a coincidence. Those platforms have compliance teams for a reason. If they won’t touch it, you shouldn’t either.

People need more posts like this. Not hype. Just facts.

Sammy Krigs

November 4, 2025 AT 06:06bruh i just bought 500k BRG on lbank bc i saw it go up 12% in 2 hrs. its gonna 10x for sure. why dont u guys understand this is the future. the devs are just working hard in secret. they dont need to show u shit. u just trust. also their website looks legit so its fine.

also why is everyone so negative? i mean if its so bad why is it even listed on bitget? they dont list scams right?

im holding till 0.001. i got faith.

ps: i think the github is just hidden. maybe its on ipfs? idk i dont know code but i know vibes.

David Roberts

November 5, 2025 AT 15:49The structural fragility of BRG is textbook. We’re witnessing a classic case of a tokenized abstraction with no material substrate. The lack of on-chain utility, combined with the absence of verifiable development, renders it ontologically inert.

Its market cap is functionally negligible - less than the cost of a decent coffee in SF. Yet, the psychological weight of its presence on four obscure exchanges creates a false illusion of legitimacy.

What’s more disturbing is the dissonance between the marketing narrative - ‘AI-driven blockchain intelligence’ - and the operational reality: a static website, zero API access, and a GitHub repo that looks like a half-finished student project from 2019.

The real risk isn’t price collapse. It’s the normalization of this kind of vaporware as ‘investment opportunities.’ We’re desensitized now. That’s the true epidemic.

Monty Tran

November 7, 2025 AT 08:55Everyone is overreacting. It's a new project. It takes time. You think Fetch.ai was built in a week? No. It took years. This is early stage. You can't judge a project by its GitHub commits. That's not how innovation works.

Also, low volume? That means there's room to grow. If everyone was already in it, there'd be no upside. You're all just jealous because you didn't get in early.

And don't even get me started on the SEC. They're just scared of innovation. They shut down everything that doesn't have a lawyer on speed dial.

BRG is the future. You just can't see it yet because you're too busy reading blog posts instead of buying the dip.

Beth Devine

November 8, 2025 AT 17:18I appreciate how thorough this breakdown is. I’ve been watching BRG for months and kept wondering why no one was talking about the lack of product. I even reached out to their support team - silence. No reply. No apology. No explanation.

It’s heartbreaking because AI + blockchain is a space with real potential. Projects like Fetch.ai and Ocean Protocol are doing the work. They’re building tools people actually use. BRG? It’s just noise.

If you’re new to crypto, please don’t let this be your first lesson. Learn from the ones that actually deliver. Don’t chase the whispers. Chase the code.

Brian McElfresh

November 10, 2025 AT 06:18THIS IS A COINMARKETCAP MANIPULATION SCAM. THEY PAID FOR THE 59K HOLDER COUNT. THEY’RE USING FAKE WALLETS TO MAKE IT LOOK LIKE PEOPLE CARE. I KNOW THIS BECAUSE I WORKED AT A BLOCKCHAIN FIRM THAT DID THIS EXACT THING FOR A CLIENT. THEY USED BOTS TO SIMULATE TRADING VOLUME. THEY USED TROLL ACCOUNTS TO POST ‘BUY THE DIP’ COMMENTS.

THEY’RE NOT EVEN ON BINANCE BECAUSE BINANCE CHECKS FOR THIS STUFF. THEY’RE ON L BANK BECAUSE L BANK LETS YOU LIST ANYTHING FOR $50K AND A PAYPAL SCREENSHOT.

AND THE WHITEPAPER? THAT WAS WRITTEN BY A GPT-4 PROMPT. I’VE SEEN THE SAME PHRASES IN OTHER SCAM PROJECTS. THEY COPY-PASTE FROM EACH OTHER.

THEY’RE GONNA DUMP IN NOVEMBER. MARK MY WORDS. I’M SAVING THIS COMMENT AS EVIDENCE.

Hanna Kruizinga

November 11, 2025 AT 09:33Ugh. Another one. I swear, every time I think crypto can’t get dumber, someone posts a 10-page breakdown of why a token is a scam and I realize - no, it’s still getting dumber.

I just bought 100 BRG because I thought it was a meme coin. Now I’m just holding it as a trophy of how gullible I was. I’m not mad. I’m just… disappointed. Like I wasted 12 seconds of my life reading this whole thing.

At least I didn’t lose much. But I lost brain cells. And that’s harder to recover.

David James

November 13, 2025 AT 03:31Good info here. I’ve been looking into AI crypto for a while now and this really helped me avoid a bad move.

I used to think if a project had ‘AI’ in the name it was smart. Turns out, most of them are just using the word to sound fancy.

Now I check GitHub first. If it’s dead, I move on. No exceptions.

Thanks for the clear list of what to look for. I’ll be sharing this with my friends who are still buying random tokens because they saw a ‘100x’ post on TikTok.

Shaunn Graves

November 13, 2025 AT 18:54Why are you even writing this? No one cares. You think your ‘analysis’ is going to stop people from buying? They’re not here for facts. They’re here for the dream. And if you’re so smart, why are you wasting your time on a $3 million token instead of investing in something real?

You’re not helping. You’re just performing. Everyone knows this is garbage. But people still buy it because they want to believe.

So go ahead. Write your long post. I’ll be over here buying my next rug pull. At least I’m not pretending I’m doing the world a favor by being ‘responsible.’

Jessica Hulst

November 13, 2025 AT 21:34There’s something almost poetic about Bridge AI - not in the way the team intends, of course. It’s the quiet tragedy of a dream that never learned to walk.

They had the right idea: AI to secure DeFi, AI to predict market behavior. But they skipped the hard parts - the code, the testing, the iteration, the failure. They went straight to the press release.

It’s not just about the token. It’s about the culture. We’ve turned crypto into a theater of hope, where the script is written by marketers, the stage is built by influencers, and the audience pays to watch themselves get fooled.

And yet… I still check the price every morning. Not because I think it’ll rise. But because I’m still hoping, against all reason, that someone, somewhere, will finally build something real.

Maybe next time.

Or maybe we’re just waiting for the next ghost to rise.

Kaela Coren

November 14, 2025 AT 13:58While the technical and market analysis presented here is methodically sound, one must also consider the sociological dimension of speculative asset behavior. The persistence of interest in low-liquidity tokens, despite transparent indicators of failure, suggests a deeper cognitive dissonance within retail investor psychology.

It is not merely ignorance that drives participation - it is the ontological need to believe in systems that promise upward mobility through technological abstraction. In this context, Bridge AI functions not as a financial instrument, but as a symbolic artifact of aspirational capitalism.

Its collapse, when it occurs, will not be a failure of engineering. It will be a failure of collective imagination - and perhaps, a necessary one.

Nabil ben Salah Nasri

November 14, 2025 AT 22:48Wow, this is so detailed! 😊👏 I really appreciate how you broke it down - like, seriously, thank you for taking the time to do this. 🙏

I’ve been thinking about getting into AI crypto for a while, and this saved me from making a huge mistake. I’m from Morocco, and here, a lot of people are jumping into these coins without checking anything. I’m going to share this with my cousin - he’s been trying to convince me to buy BRG.

Also, I’m glad you mentioned the exchanges. I didn’t realize how big of a red flag it is that it’s not on Binance or Coinbase. That alone would’ve made me pause.

Thanks again. You’re a real one. 💪🌍