Argentina Crypto Conversion Calculator

Calculate your net peso value after VASP fees and government taxes under Argentina's 2025 regulations. Note: Taxes range from 5-15% depending on transaction type.

Conversion Details

Conversion Process

Under Argentina's 2025 regulations, you must use a registered Virtual Asset Service Provider (VASP) for all crypto transactions. Key Fact Banks cannot process crypto transactions directly.

All VASPs must be registered with Argentina's National Securities Commission (CNV) by September 1, 2025. Tax Note: Government tax rates range from 5-15% depending on transaction type.

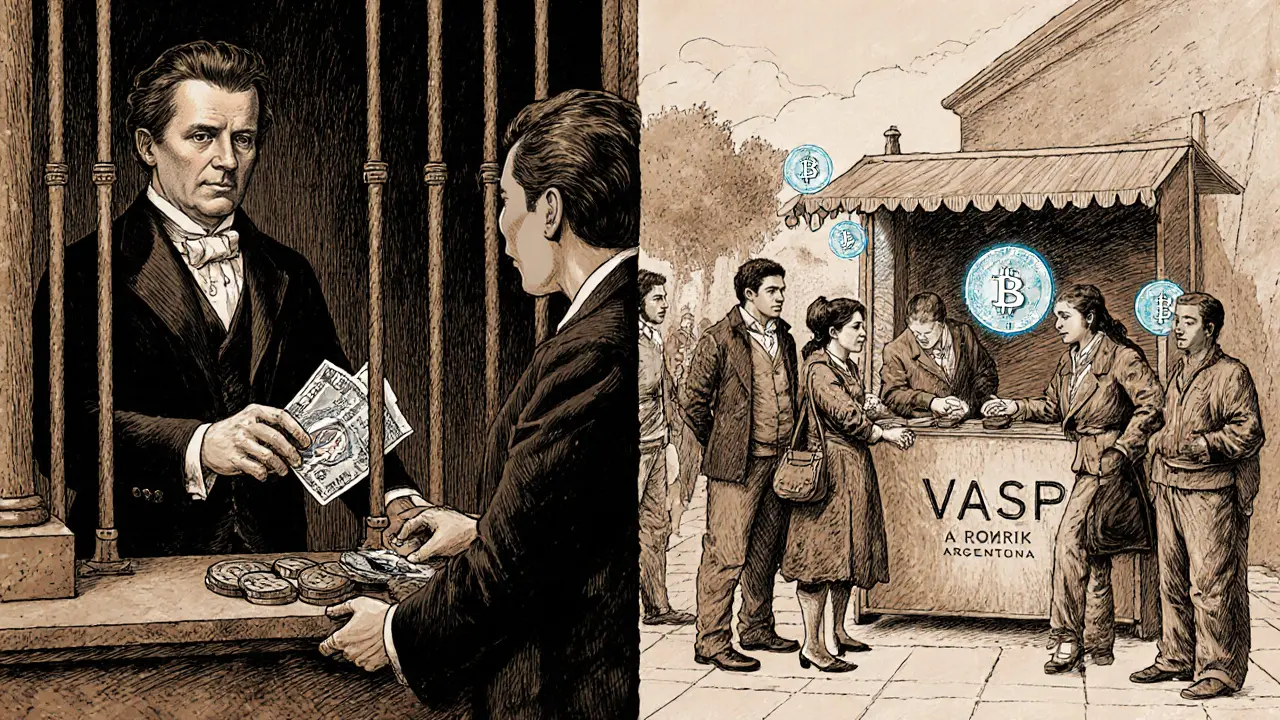

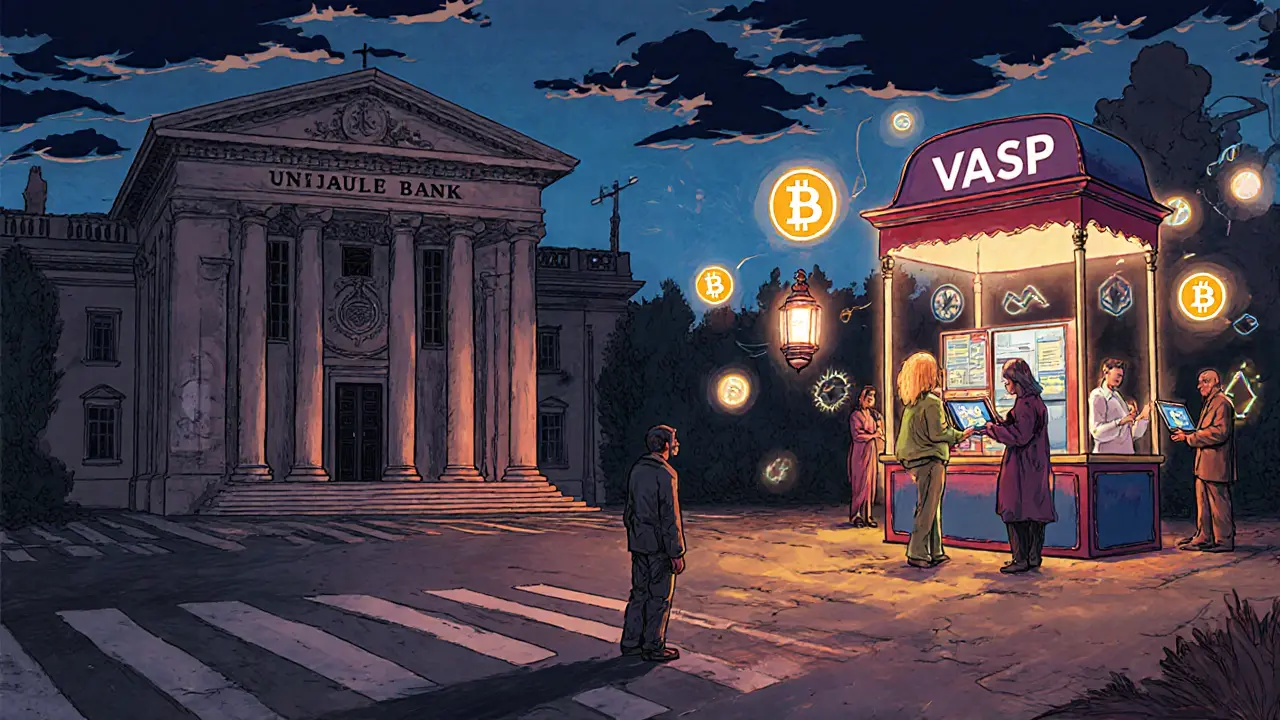

Argentinians can buy and sell crypto freely-but not through their banks. That’s the reality in 2025. Despite being one of the most crypto-savvy countries in Latin America-with 30% of adults owning digital assets-Argentina has drawn a hard line: traditional banks are banned from touching cryptocurrency. It’s not a crackdown. It’s a separation. And it’s reshaping how money moves in the country.

Why Banks Can’t Touch Crypto Anymore

The Banco Central de la República Argentina (BCRA) didn’t ban crypto. It banned banks from handling it. The goal? Protect the country’s foreign exchange reserves. With inflation hovering around 200% in 2024 and the peso losing value fast, Argentinians turned to Bitcoin, USDT, and other stablecoins as a lifeline. But when banks started offering crypto services-custody, trading, even crypto-backed loans-the central bank got nervous. They feared capital flight, money laundering, and a collapse in peso demand. So in early 2025, they pulled the plug. This wasn’t a surprise move. It followed Law 27,739, passed in March 2024, which gave the National Securities Commission (CNV) authority over virtual assets. The message was clear: crypto isn’t going away. But it’s not part of the banking system either.How Crypto Transactions Work Now

If you want to buy or sell crypto in Argentina today, you have to go through a registered Virtual Asset Service Provider (VASP). These are licensed companies-like exchanges, wallets, or trading platforms-that meet strict rules set by the CNV. Banks can’t offer these services. Not even as a side feature. No crypto ATMs at Banco Galicia. No crypto deposits at Santander. No peer-to-peer trading through Mercado Pago. VASPs must register with the CNV by September 1, 2025, if they serve Argentinian users. They need a minimum net worth in USD, full KYC checks, and real-time monitoring of transactions. They also have to report suspicious activity to the Financial Intelligence Unit (UIF) within 150 days. Monthly reports on client numbers, trading volumes, and top assets are mandatory. For users, this means two separate financial lives: one with your bank for pesos and salaries, and another with a VASP for crypto. You can’t transfer crypto directly from your bank account to your wallet anymore. You have to move pesos to a VASP, buy crypto, then send it out. And if you want to cash out? You sell crypto on a VASP, then withdraw pesos to your bank account. It’s clunky-but legal.What’s Allowed-and What’s Not

Here’s what banks can’t do in 2025:- Offer crypto trading or exchange services

- Custody digital assets for customers

- Process crypto-to-peso conversions

- Accept crypto as collateral for loans

- Integrate crypto wallets into their apps

- Using stablecoins like USDT to protect savings

- Buying dollars directly with crypto through licensed VASPs

- Tokenizing real estate, stocks, or art via blockchain (thanks to CNV Resolution 1069/2025)

- Trading crypto across borders using VASPs (though a 5-15% tax applies)

- Declaring crypto holdings under the government’s ‘blanqueo’ tax amnesty program (deadline: September 30, 2025)

Who’s Affected the Most?

Small VASPs are struggling. The compliance costs-KYC software, audits, reporting tools-are expensive. Many can’t afford to bank with traditional institutions because banks won’t touch them. So they’re stuck: no bank account, no payroll system, no way to pay vendors in pesos. Some are turning to offshore banking or crypto-native financial services like Circle or Binance Pay, but that’s risky and unstable. Tourists and digital nomads face headaches too. You can’t walk into a café in Buenos Aires and pay with Bitcoin through a bank-linked app. You need a VASP wallet, and you need to know which places accept it. Some hostels, cafes, and co-working spaces do-but it’s patchy. Most still take pesos or dollars in cash. Even Argentinians who’ve been using crypto for years are adjusting. Many kept their crypto in bank-integrated wallets before 2025. Now they’re moving funds to standalone apps like Bitso, Ripio, or Binance Argentina. The transition wasn’t smooth. Some lost access to funds during the switch. Others got locked out because their bank froze accounts linked to crypto activity.How This Compares to Other Countries

Most countries either ban crypto outright (like Nigeria did in 2021) or fully integrate it into banking (like El Salvador with Bitcoin as legal tender). Argentina chose a third path: regulate it hard, but keep it out of the banking system. Brazil allows banks to offer crypto services, but with heavy oversight. Colombia lets banks custody crypto under strict limits. Argentina’s model is unique: no bank involvement at all. It’s like creating a parallel financial system-one that’s more transparent, more regulated, but also more fragmented. The result? Crypto use is still high. Stablecoin volumes hit $12 billion in monthly trades in Q3 2025. But the growth is happening outside the traditional system. That’s intentional.

Vaibhav Jaiswal

November 28, 2025 AT 10:53Man, this is wild. I’ve seen crypto thrive in places where banks are broken, but Argentina’s doing something totally different-like building a parallel economy on purpose. I’m impressed. Not everyone gets that this isn’t about banning crypto, it’s about saving the peso by keeping it out of the banking system. Smart move, even if it’s messy.

Abby cant tell ya

November 30, 2025 AT 03:24So let me get this straight-you can’t use crypto through your bank, but you can buy a house with it? Sounds like a government-sponsored glitch. 😂

Savan Prajapati

December 1, 2025 AT 21:09Banking system is broken. Crypto is the backup. Simple.

jeff aza

December 3, 2025 AT 01:47Let’s be real: this isn’t innovation-it’s regulatory overcompensation. You’re creating a two-tiered financial system where compliance costs are crushing small VASPs, while the central bank pretends it’s ‘controlling risk.’ Meanwhile, the real risk is stagnation. No bank integration means no institutional capital. No institutional capital means no real adoption. Just a bunch of KYC-heavy exchanges playing whack-a-mole with regulators. And don’t even get me started on the 5-15% tax on cross-border trades-what is this, 1987?

Brian Bernfeld

December 3, 2025 AT 06:01As someone who’s lived in Buenos Aires for 5 years, I’ve watched this unfold. The VASP transition was brutal-people lost access to funds because their bank froze accounts linked to crypto. But here’s the thing: now, every transaction is traceable. That’s huge. Before, crypto was a black box. Now, the UIF can track suspicious flows. That’s not just regulation-it’s accountability. And yes, it’s clunky. But clunky beats chaos. Plus, tokenized real estate? That’s the future. Argentina’s not behind. They’re ahead of the curve on transparency.

Also, tourists? Bring cash. Seriously. I tried paying for empanadas with USDT last month. The guy laughed, then gave me three extra because he felt bad for me. That’s Argentina for you.

Michael Labelle

December 4, 2025 AT 23:38I’ve seen this model work in places with hyperinflation-Venezuela, Lebanon. Argentina’s version is cleaner because the government didn’t panic. They didn’t ban it. They just said, ‘You want crypto? Fine. But don’t drag our banks into it.’ That’s leadership. Most countries either go full crypto or full ban. Argentina picked the hard middle path. Respect.

Joel Christian

December 5, 2025 AT 01:12so like… can u buy bitcoin with ur bank card? or no? i mean like… is it even worth it if u gotta transfer pesos first? this sounds like a nightmare

Vaibhav Jaiswal

December 6, 2025 AT 22:18It’s a nightmare… until you realize your savings aren’t evaporating every month. Yeah, you gotta move pesos to a VASP, buy crypto, then send it out. But that’s the price of keeping your money alive. I used to lose 10% of my salary every week to inflation. Now I hold USDT. It’s not perfect, but it’s better than watching your rent money turn into paper.

fanny adam

December 8, 2025 AT 17:33This is a distraction. The central bank is using crypto regulation as a smokescreen to hide the fact that they’re printing money to fund political patronage. The VASPs? They’re all front companies for offshore money launderers. And the ‘tokenized real estate’? That’s just a way for elites to move assets abroad under the guise of ‘innovation.’ Don’t be fooled. This isn’t progress-it’s a controlled collapse.

Tom MacDermott

December 9, 2025 AT 02:53Oh wow, look who’s ‘channeling’ crypto now. The same government that couldn’t keep inflation under 100% for a decade suddenly knows how to ‘regulate’ it? Please. This is just the state trying to pretend it’s in control. Meanwhile, real innovation is happening on the darknet, not on some CNV-approved exchange. You think they’re tracking transactions? They’re just tracking the people who still believe in paperwork.

Martin Doyle

December 11, 2025 AT 02:35Why does everyone keep acting like this is genius? You’re making life harder for normal people just to protect a currency that’s worthless anyway. If the peso’s collapsing, fix the economy. Don’t make people jump through hoops to buy Bitcoin. This isn’t regulation-it’s punishment.

Brian Bernfeld

December 11, 2025 AT 21:45Fix the economy? They tried. They’ve tried everything. Printing money, pegging to the dollar, currency controls. None of it worked. This? This is the only thing that’s actually kept people from starving. You think someone’s jumping through hoops? They’re just moving money so their kids can eat. This isn’t punishment. It’s survival.

And if you think VASPs are making life harder, try being a small business owner who can’t open a bank account because no bank will touch you after you used crypto to pay suppliers. That’s the real pain point. The government’s ignoring that. And that’s the flaw in this whole system.

imoleayo adebiyi

December 12, 2025 AT 18:59I come from Nigeria, where crypto is the only thing keeping small businesses alive after the central bank shut down digital payments. Argentina’s approach is different, but the heart is the same: people are using tech to survive bad systems. I don’t think it’s perfect, but I think it’s honest. They’re not pretending the peso is stable. They’re not pretending banks are trustworthy. They’re saying, ‘Here’s what works-use this, and we’ll watch it closely.’ That’s better than lying to people.

Christina Oneviane

December 14, 2025 AT 03:23So… you’re telling me I can’t use crypto to pay for my Uber in Buenos Aires, but I can buy a yacht with it? That’s not a financial system. That’s a sitcom.

Vijay Kumar

December 15, 2025 AT 18:09It’s not about crypto. It’s about power. The state doesn’t want people to have alternatives. It wants them to depend on the peso. So they made crypto legal-but impossible to use with the system. That’s not regulation. That’s psychological control.

Kristi Malicsi

December 16, 2025 AT 19:59Money is just a story we all agree on. Argentina’s rewriting the story. Banks are the old tale. Crypto is the new one. The government’s just trying to write the footnotes

Susan Dugan

December 17, 2025 AT 07:35Y’all are overcomplicating this. People in Argentina aren’t fighting the system-they’re outsmarting it. They’re using crypto like a secret language. Banks? They’re for paying rent and buying bread. Crypto? That’s for living. It’s not broken-it’s evolved. And honestly? I wish more countries had the guts to do this. Not ban. Not embrace. Just… let people find their own way.

Vance Ashby

December 17, 2025 AT 22:03So… if I send USDT to my cousin in Argentina, and they cash out via a VASP… do they get taxed? Or is that just for ‘cross-border’ trades? 😅