EU Privacy Coin Deadline Countdown

Time Until EU Privacy Coin Ban

Monero (XMR) and Zcash (ZEC) will be banned on European Union-regulated platforms starting July 1, 2027. This timer shows how much time you have to prepare before the deadline.

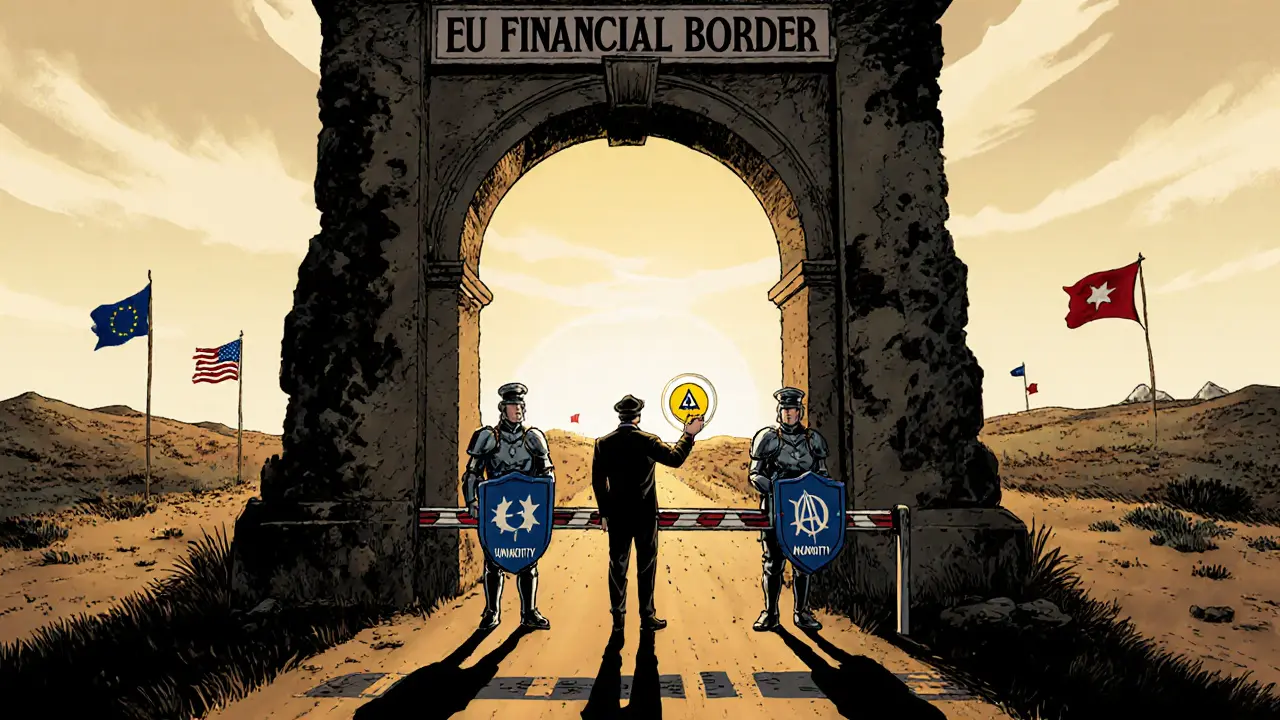

Move to non-EU exchange

Research and test exchanges outside EU jurisdiction like SwissBorg, Bitfinex, or Kraken (non-EU).

Secure your keys

Transfer coins to hardware wallets like Ledger or Trezor before deadline.

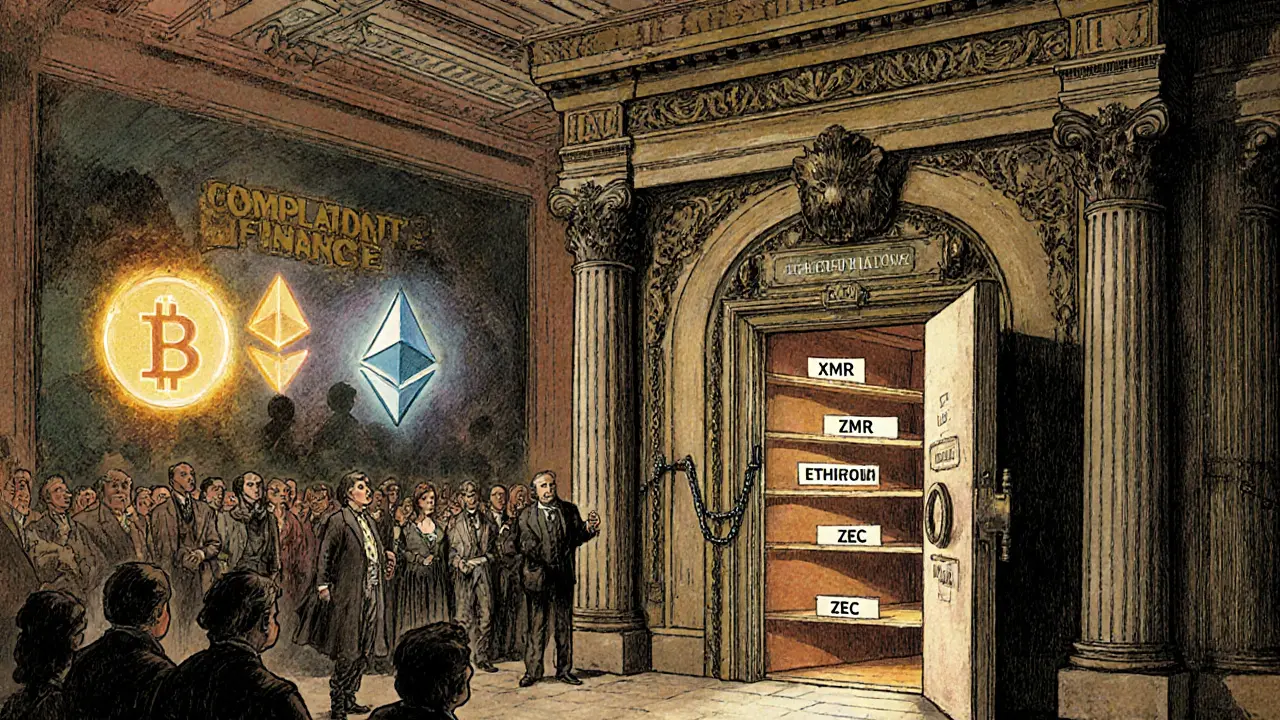

Convert to compliant coins

Swap privacy coins to Bitcoin or Ethereum before deadline using P2P platforms.

Privacy coins like Monero and Zcash are set to be banned in the European Union by July 1, 2027

If you own Monero, Zcash, or any other privacy-focused cryptocurrency, the EU’s new rules are going to change how you use them-maybe even force you to move them out of the bloc. Starting in 2027, any crypto exchange, bank, or service provider operating under EU law will be legally required to stop supporting these coins. It’s not a suggestion. It’s not a warning. It’s a full ban built into Regulation 2024/1624, the EU’s latest anti-money laundering law.

This isn’t about cracking down on criminals. It’s about control. The EU doesn’t want transactions that can’t be traced. Monero hides sender, receiver, and amount using ring signatures and stealth addresses. Zcash lets users choose shielded transactions that encrypt all details. To regulators, that’s not privacy-it’s a blind spot. And blind spots don’t fit in a financial system that demands full transparency.

Why the EU is targeting Monero and Zcash specifically

Not all cryptocurrencies are treated the same. Bitcoin and Ethereum leave a clear trail. Every transaction is public. You can follow the money-even if you don’t know who owns it. Privacy coins break that chain. That’s exactly why they’re popular with people who value anonymity. But it’s also why regulators see them as dangerous.

Article 79 of the new EU law explicitly bans "crypto-asset accounts allowing anonymization of transactions." That’s the legal phrase that kills Monero and Zcash in Europe. It doesn’t matter if you’re buying coffee or sending money to family. If the coin can hide who sent it, who received it, or how much was sent, it’s banned from EU-regulated platforms.

There’s no gray area. Dash, Verge, and other privacy coins are also caught in this net. But Monero and Zcash are the biggest targets because they’re the most widely used. They’re not fringe projects. They’re top 50 coins by market cap. That’s why the EU picked them.

How the ban works in practice

The ban doesn’t target individuals. You won’t be arrested for holding Monero in your wallet. But if you try to trade it on Kraken, Binance, or any exchange with EU licenses, you’ll hit a wall. Those platforms will be forced to block deposits and withdrawals for privacy coins. They’ll also have to cut off any trading pairs-XMR/EUR, ZEC/BTC, you name it.

Even decentralized exchanges (DEXs) that operate within EU borders will need to comply. If a DEX is registered as a crypto-asset service provider under MiCA, it can’t offer privacy coins. The only way around this is to move entirely outside EU jurisdiction.

There’s also a new watchdog: AMLA, the Anti-Money Laundering Authority. It will monitor the 40 largest crypto firms in the EU-those handling over €50 million in transactions or serving tens of thousands of users. These firms will have to prove they’re not processing privacy coin trades. Fines for non-compliance can reach up to 5% of global revenue.

What happens to your coins after July 2027

You can still own Monero or Zcash. The EU doesn’t make possession illegal. But you won’t be able to cash out through local exchanges. You won’t be able to use them to pay for goods or services through EU-based merchants who accept crypto. And if you try to send them to a wallet tied to a European bank account, the transaction might get flagged or blocked.

That leaves three real options:

- Move to a non-EU exchange. Use platforms based in places like Switzerland, Singapore, or the UAE. You’ll need to handle KYC yourself, but you can still trade.

- Use peer-to-peer (P2P) networks. Platforms like LocalMonero or Bisq let users trade directly. No central authority means no ban enforcement.

- Convert to a compliant coin. Swap your Zcash or Monero for Bitcoin or Ethereum before the deadline. Then hold it on a non-EU wallet. It’s not ideal, but it’s the safest path.

There’s no legal way to use privacy coins inside the EU’s regulated financial system after 2027. The door is closing.

Why this matters beyond Europe

The EU isn’t just making its own rules-it’s setting the global standard. When the world’s largest single market bans something, other countries pay attention. The U.S. SEC has already signaled interest in similar restrictions. The UK, Canada, and Australia are watching closely. If the EU succeeds in cutting off privacy coins from its banking system, it becomes much harder for them to survive as mainstream assets.

This isn’t just about money laundering. It’s about power. The EU is saying: if you want to operate here, you play by our rules. And our rules say: no hidden transactions. No untraceable payments. No financial privacy.

Privacy advocates argue this is a violation of basic rights. They say financial privacy is as important as digital privacy. But regulators counter that the cost of anonymity is too high. They point to cases where Monero was used in ransomware attacks and darknet marketplaces. They say the risk outweighs the benefit.

What you should do now (before 2027)

You have two years to prepare. That’s not a lot if you’re holding a large amount. Here’s what to do:

- Don’t panic sell. Prices may dip as traders react to the news, but there’s no reason to dump your coins at a loss.

- Start researching non-EU exchanges. Find one with good liquidity, low fees, and strong security. Test it with a small amount first.

- Secure your private keys. If you’re holding on an exchange, move your coins to a wallet you control. Hardware wallets like Ledger or Trezor are best.

- Understand tax implications. Converting privacy coins to Bitcoin or Ethereum may trigger capital gains taxes in your country. Talk to a local tax advisor.

- Stay updated. The European Banking Authority is still finalizing technical details. The law is locked, but how it’s enforced might change slightly.

The goal isn’t to fight the ban. It’s to adapt. The EU’s decision is final. Resistance won’t change it. Planning will.

What this means for the future of crypto

This ban marks a turning point. Crypto is no longer a wild west. It’s becoming part of the traditional financial system-and that system demands transparency. Coins that can’t comply won’t survive in major markets.

Monero and Zcash won’t disappear. They’ll just move. Developers will keep building. Communities will keep using them. But their home will be outside the EU, the U.S., and other regulated zones. They’ll become niche tools for people who need anonymity, not mainstream assets.

For the rest of us, it means crypto is becoming more like banking. More regulated. More monitored. Less anonymous. That’s the direction the world is heading. The EU just moved fastest.

If you believe in financial privacy, this is a warning. If you believe in compliance, this is progress. Either way, the clock is ticking. July 1, 2027 is coming. And when it does, the rules will change forever.

Kymberley Sant

November 1, 2025 AT 03:08Edgerton Trowbridge

November 2, 2025 AT 05:48Matthew Affrunti

November 3, 2025 AT 10:14mark Hayes

November 4, 2025 AT 20:07Derek Hardman

November 5, 2025 AT 05:27Debby Ananda

November 6, 2025 AT 04:50Vicki Fletcher

November 6, 2025 AT 15:37Ron Cassel

November 8, 2025 AT 14:52ISAH Isah

November 8, 2025 AT 15:21Eric Redman

November 9, 2025 AT 04:16