Bitcoin isn’t just digital money-it’s a global machine powered by electricity, silicon, and cold air. At its core, the network’s security depends on something called the hash rate. This isn’t a number you can touch, but it’s what keeps Bitcoin safe from hackers, fraud, and central control. As of October 2025, the Bitcoin network is running at over 1,020 exahashes per second (EH/s), meaning billions of billions of calculations are being done every second to verify transactions and add new blocks. But here’s the real question: Where is all that power coming from?

Why Hash Rate Distribution Matters

The hash rate isn’t just a technical detail. It’s a measure of how secure Bitcoin is. More computing power spread across many places means it’s harder for any single group to take over the network. If one country or company controlled over 50% of the hash rate, they could theoretically reverse transactions or block others-something called a 51% attack. That’s why where miners are located matters just as much as how many there are.Since China banned Bitcoin mining in 2021, the map of Bitcoin mining has completely changed. What was once a decentralized, global hobbyist network is now a highly industrialized, energy-driven industry. Today, the distribution of hash rate reflects not just technology, but politics, energy policies, and climate conditions.

The United States: The New Mining Superpower

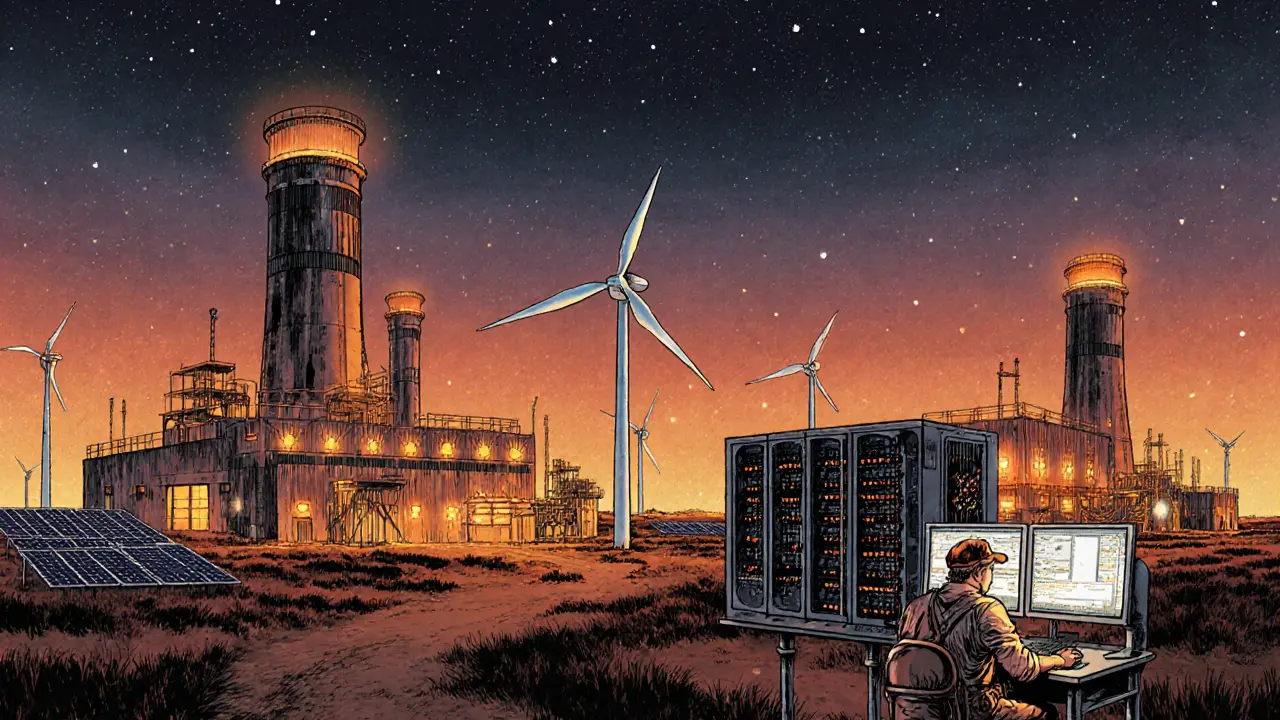

As of 2025, the United States controls 44% of the world’s Bitcoin hash rate. That’s nearly half of the entire network. How did this happen?After China’s crackdown, miners moved quickly. Texas became the epicenter-not because of cheap coal, but because of deregulated electricity markets and aggressive renewable energy incentives. During periods of low demand, Texas grid operators pay miners to use excess power, turning them into grid stabilizers. Other states like Georgia, Kentucky, and Washington are also growing fast, drawn by low-cost hydro and wind energy.

Large mining farms in Texas now use next-generation ASICs that are 35% more efficient than models from just two years ago. These machines run 24/7, cooled by industrial ventilation systems and housed in repurposed warehouses. The U.S. advantage isn’t just energy-it’s legal clarity. Unlike many countries, the U.S. doesn’t treat Bitcoin mining as illegal or risky. That stability attracts institutional investors, hedge funds, and public companies looking to allocate capital with confidence.

Kazakhstan and Russia: Energy Arbitrage on the Edge

Kazakhstan holds 12% of the global hash rate. It’s a story of opportunity and instability. The country has abundant natural gas and coal, and for years, it offered low electricity rates and tax breaks to attract miners. But in 2024, after a surge in demand that strained the national grid, the government imposed new restrictions and export controls. Some miners left. Others adapted-moving to remote regions with surplus power and unreliable internet, relying on satellite backups.Russia accounts for 10.5% of the hash rate, and its growth is unusual. In places like Siberia and the Far North, oil companies flare off excess natural gas-burning it into the air as waste. Miners set up operations right next to these flare sites, capturing that wasted energy to power their rigs. It’s not just profitable-it’s environmentally smarter than letting the gas burn unused. Russian miners also benefit from cold climates, which naturally cool hardware without expensive air conditioning.

Canada: Renewable Power Meets Stability

Canada holds steady at 9% of the global hash rate, with Alberta and Quebec leading the way. Quebec, in particular, is a mining hotspot because of its massive hydroelectric dams. Over 95% of the province’s electricity comes from renewable hydropower, making it one of the cleanest places on Earth to mine Bitcoin.Canadian miners aren’t just chasing low rates-they’re marketing themselves as sustainable. Some firms now publish monthly carbon reports, showing their mining operations have a smaller footprint than traditional banking systems. Institutional investors, especially in Europe, are increasingly choosing Canadian-based mining operations for ESG (Environmental, Social, and Governance) compliance.

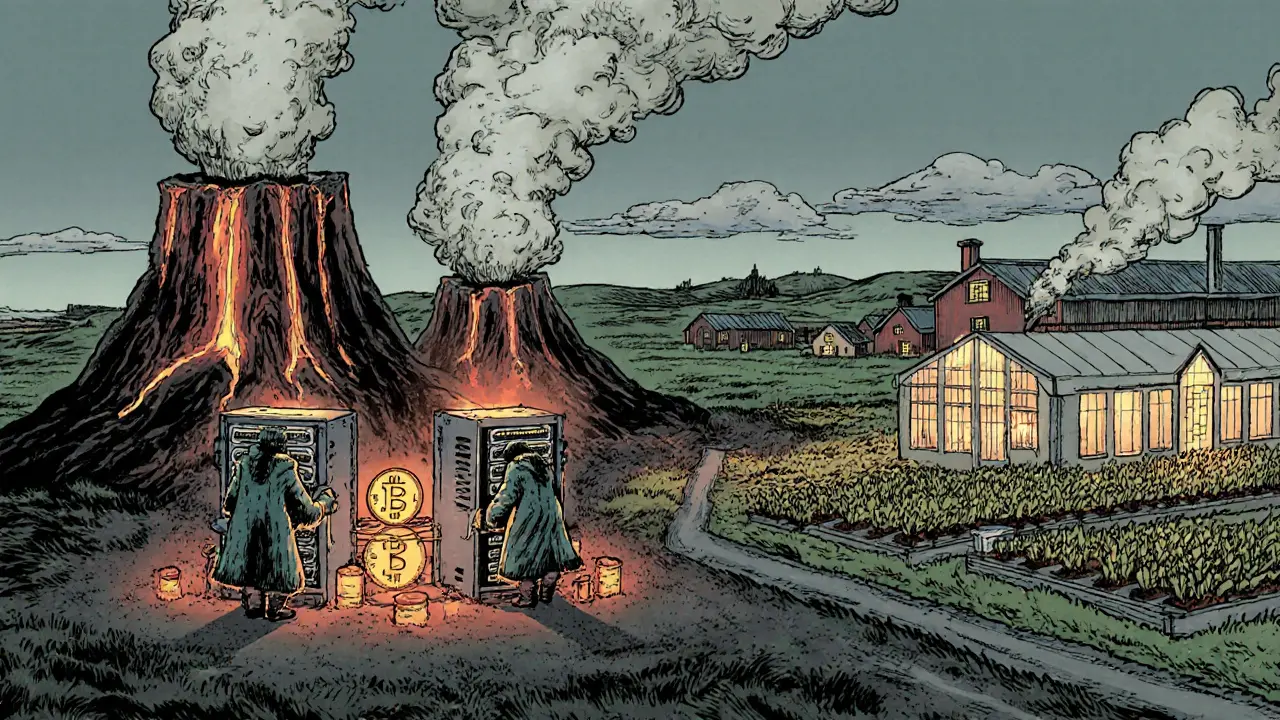

The Nordic Nations: The Green Miners

Iceland and Norway are tiny in population, but massive in mining influence. Iceland powers over 92% of its mining with geothermal and hydro energy. Norway uses 96% hydropower. These countries don’t have cheap labor or big factories-they have cold weather and clean electricity.In Iceland, miners are often located near volcanic power plants. The waste heat from their rigs is even reused to warm greenhouses and swimming pools. In Norway, some mining farms are built inside repurposed fish processing plants, using the existing infrastructure and cold coastal air to keep hardware running efficiently.

These countries attract mining operators not because they’re the cheapest, but because they’re the most reliable. No blackouts. No sudden policy shifts. Just steady, green power. For long-term investors, that’s worth more than a few cents per kilowatt-hour.

Iran: Mining Under Sanctions

Iran contributes 4.2% of the global hash rate, despite international sanctions and frequent power rationing. The government doesn’t officially endorse Bitcoin mining, but it also doesn’t stop it. Why? Because it’s a way to generate hard currency and use excess electricity that would otherwise go to waste during peak demand.Iranian miners often run rigs during off-peak hours when the grid is overloaded and electricity is free or heavily subsidized. But it’s risky. Power cuts are common. Internet access is unreliable. And if the government decides to crack down, miners can lose everything overnight. Still, the numbers keep growing-proof that even under pressure, Bitcoin’s network finds a way.

How Hash Rate Is Measured (And Why It’s Not Perfect)

You might wonder: How do we even know these numbers? The answer is messy.Researchers track where mining pools-groups of miners who combine their power-are located by analyzing IP addresses. But many miners use VPNs or proxy servers to hide their real location. That means countries like Germany and Ireland sometimes show up with inflated numbers because miners route traffic through them for privacy.

The Cambridge Centre for Alternative Finance is one of the most trusted sources, but even they admit their data is delayed by one to three months. Real-time tracking is nearly impossible. What we see today is a snapshot, not a live feed.

Another challenge: hash rate doesn’t tell you how much energy is being used. Two miners with the same hash rate could be using vastly different amounts of electricity depending on their equipment. New ASICs can do more work with less power-making efficiency just as important as raw computing power.

What’s Next for Bitcoin Mining?

The future of hash rate distribution will be shaped by three things: energy, regulation, and technology.Energy will keep driving location choices. Countries with cheap, renewable power will win. Coal-dependent regions will struggle as global climate policies tighten.

Regulation will decide who stays and who leaves. The U.S., Canada, and the Nordics are winning because they offer predictability. Places with unclear laws-like parts of Africa and Southeast Asia-will remain risky.

And technology? The next leap isn’t just faster ASICs. It’s heat reuse. Some companies are now piping waste heat from mining rigs into homes, greenhouses, and even district heating systems. This turns Bitcoin mining from an energy sink into a useful energy service.

One thing’s clear: Bitcoin’s network is more resilient than ever. It’s no longer dependent on one country, one policy, or one energy source. It’s a distributed, adaptive system that moves where the power is-and where the rules allow it to stay.

Frequently Asked Questions

What is Bitcoin hash rate?

Bitcoin hash rate is the total computational power used by the Bitcoin network to process transactions and secure the blockchain. It’s measured in exahashes per second (EH/s) and reflects how many calculations miners are performing every second to solve cryptographic puzzles. Higher hash rates mean a more secure network.

Why does geographic distribution of hash rate matter?

If too much hash rate is concentrated in one country or controlled by one group, the network becomes vulnerable to censorship or attacks. Geographic diversity ensures that no single government or entity can easily shut down Bitcoin. It’s a key part of Bitcoin’s decentralization.

Which country has the most Bitcoin mining power?

As of October 2025, the United States leads with 44% of the global hash rate, followed by Kazakhstan at 12%, Russia at 10.5%, and Canada at 9%. This is a major shift from 2020, when China controlled over 70%.

Is Bitcoin mining bad for the environment?

It depends on where it’s done. Mining powered by coal or gas can have a large carbon footprint. But in places like Iceland, Norway, and Quebec, over 90% of mining uses renewable energy. Some operators even use wasted gas from oil fields or excess hydro power that would otherwise be curtailed. The industry is shifting toward sustainability-not away from it.

How often does Bitcoin’s hash rate change?

The network adjusts mining difficulty every 2,016 blocks-roughly every two weeks-to keep block times at about 10 minutes. If more miners join, the difficulty goes up. If miners leave, it goes down. The actual hash rate can swing daily based on electricity prices, equipment upgrades, or regulatory news.

Chloe Jobson

October 28, 2025 AT 07:21US dominance at 44% is wild. Texas isn't just mining-it's becoming the grid's shock absorber. When wind drops, miners throttle down. When solar surges, they crank up. That’s not just crypto-it’s infrastructure innovation.

And the efficiency gains? ASICs now do more with 35% less juice. We’re not just hashing-we’re optimizing energy use like never before.

Andrew Morgan

October 29, 2025 AT 21:02bro the fact that russian miners are literally stealing gas flare energy is next level

they’re not polluting more-they’re turning waste into crypto. that’s not mining that’s environmental hackery

Michael Folorunsho

October 30, 2025 AT 17:14Let’s be real. The US isn’t just leading-it’s redefining the game. Other countries are playing catch-up with coal and desperation. We have legal clarity, institutional capital, and the most advanced mining rigs on Earth. This isn’t luck. It’s superiority.

Roxanne Maxwell

October 30, 2025 AT 22:35I love how Canada’s mining is quietly becoming the greenest in the world. Hydro power, carbon reports, ESG compliance-it’s not flashy but it’s sustainable. People forget Bitcoin can be part of the solution, not just the problem.

Jonathan Tanguay

October 30, 2025 AT 23:02you guys are missing the point the hash rate numbers are totally faked because most miners use vpn and proxy servers to hide their real location so like germany and ireland show up with inflated numbers because they’re just routing traffic through them for privacy so like the real numbers are probably way different and also the cambridge data is delayed by months so like we’re all just guessing and also new asics are way more efficient so the actual energy usage is way lower than people think and also like the whole 51 percent attack thing is a myth because even if one country had 50 percent it would be too expensive to actually execute and they’d destroy the value of their own investment so like the whole fear is manufactured by people who don’t understand the economics

Ayanda Ndoni

November 1, 2025 AT 22:25why is everyone talking about usa and canada when africa has like 10x the solar potential and zero regulation? we could be the next mining hub if anyone actually cared to invest here instead of just watching from their couch

Elliott Algarin

November 2, 2025 AT 06:18It’s fascinating how Bitcoin’s hash rate distribution mirrors global energy transitions. The network isn’t just surviving-it’s adapting. It’s becoming a living system that responds to policy, climate, and economics. Maybe that’s the real innovation: a decentralized machine that evolves without a central brain.

John Murphy

November 2, 2025 AT 07:22Iran’s mining under sanctions is insane. They’re using off-peak electricity that would otherwise be wasted. No one talks about this but it’s a quiet win for decentralization. Even under pressure, the network finds a way. That’s Bitcoin’s real strength.

Zach Crandall

November 3, 2025 AT 08:14As a Canadian miner, I can confirm: Quebec’s hydro is the gold standard. We don’t need subsidies. We don’t need hype. We just need cold air and clean water. The ESG reports aren’t marketing-they’re fact. European institutions are choosing us because they know the numbers don’t lie.

Akinyemi Akindele Winner

November 3, 2025 AT 22:09USA 44%? Nah. That’s just the tip of the iceberg. The real power is in the shadows-where the rigs hum under military bases, in abandoned mines, behind firewalls no one dares to crack. The numbers you see? They’re the public face. The real game? It’s run by ghosts with diesel generators and satellite links.

Patrick De Leon

November 4, 2025 AT 16:51Ireland is not a mining hub. It’s a routing trap. The data is skewed. The whole thing is a farce. The US is not superior-it’s just louder. And the so-called green mining? It’s a PR stunt. Energy is energy. Stop pretending Bitcoin is eco-friendly.

MANGESH NEEL

November 6, 2025 AT 10:15THIS IS A DISGRACE. The US is monopolizing Bitcoin like it’s their private utility. This isn’t decentralization-it’s corporate capture. And you people are celebrating it like it’s a victory? Wake up. The whole point of Bitcoin was to break power centers. Now we have a new empire built on Texas power grids and hedge fund money. This is betrayal.

Sean Huang

November 7, 2025 AT 07:22Did you know the hash rate numbers are controlled by the Fed? They use the mining pools to track crypto activity and feed it into their surveillance algorithms. The US dominance? It’s not organic. It’s orchestrated. The cold air in Iceland? It’s a decoy. The real rigs are underground in Nevada, synced with satellite networks. They’re not mining Bitcoin-they’re mining your data. The grid stabilizers? They’re the new NSA.

They told you it was about freedom. It was always about control.

They’re watching you. Always.

:-O

Ali Korkor

November 7, 2025 AT 15:03Love this breakdown. Seriously. Most people think mining is just about electricity. But it’s about resilience. It’s about using waste gas, excess wind, frozen air. This isn’t a glitch in the system-it’s the system working exactly as it should.

madhu belavadi

November 8, 2025 AT 06:34why do we even care where the hash rate is? it’s just numbers. the blockchain doesn’t care about geography. it’s just code.

Dick Lane

November 9, 2025 AT 14:01Canada’s green mining is legit. But don’t forget Iceland. Those volcanic power plants are next level. Waste heat warming pools? That’s not mining. That’s alchemy.

Norman Woo

November 9, 2025 AT 14:12they’re not really using geothermal in iceland… it’s all just hydro with a fancy label. and the fish plant thing? total myth. no one’s mining in fish plants. that’s just clickbait. the real mining is in secret warehouses near the airport. i’ve seen the trucks.