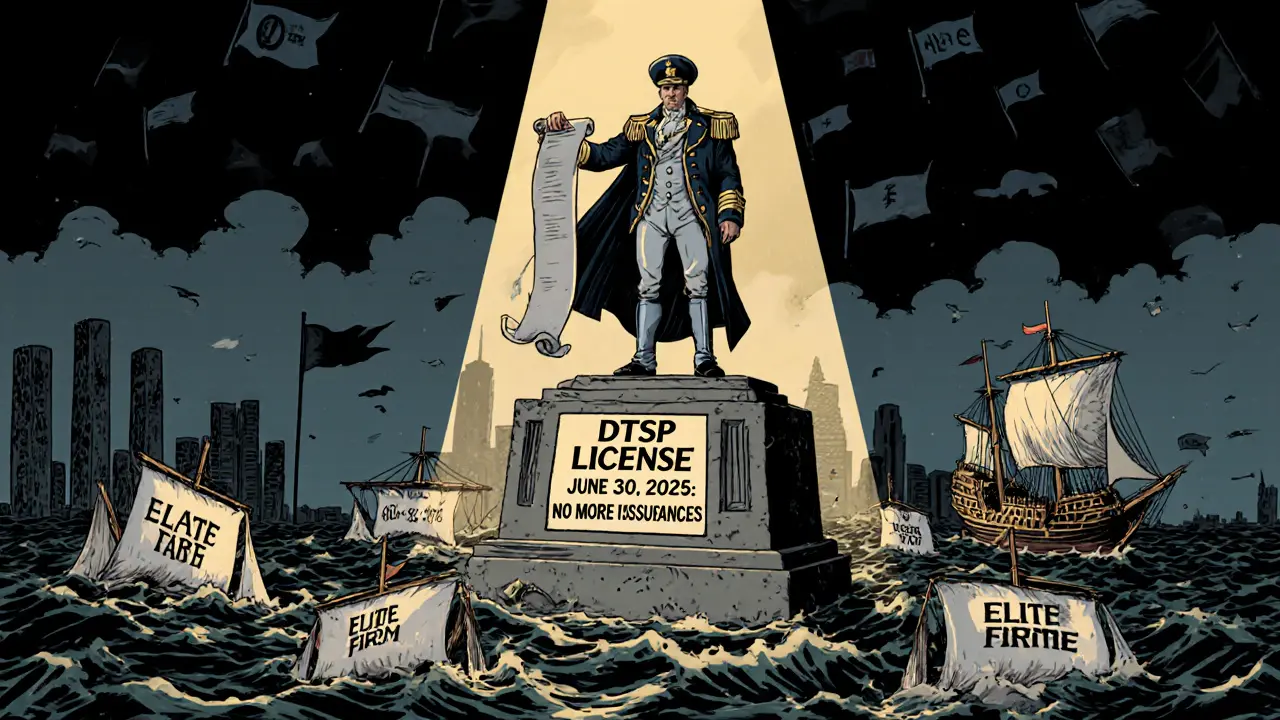

On June 30, 2025, Singapore’s crypto industry changed forever. The Monetary Authority of Singapore (MAS) stopped issuing new licenses for digital token service providers - and made it clear they won’t issue more unless absolutely necessary. This wasn’t a slow policy shift. It was a hard stop. No grace period. No extensions. If your company wasn’t fully compliant by that date, you’re no longer allowed to operate from Singapore - even if your customers are in Brazil, Nigeria, or Canada.

Why MAS Changed Course

Singapore used to be one of the most welcoming places in the world for crypto companies. Low taxes, strong infrastructure, and a reputation for clean financial regulation drew firms from around the globe. But MAS noticed something troubling: companies were registering in Singapore not to serve local customers, but to use the country’s name as a stamp of legitimacy. They’d set up a small office, hire one compliance officer, and then run their entire business from overseas - often with weak or no AML controls. MAS called this regulatory arbitrage. It wasn’t just unfair. It was dangerous. If a Singapore-registered crypto firm got caught laundering money or funding terrorism, the whole country’s financial reputation would take a hit. So MAS decided to protect its name - even if it meant killing its own crypto boom.The New Rules: DTSP License Requirements

Under the Financial Services and Markets Act 2022 (FSMA), any company offering crypto services - exchanges, wallet providers, trading platforms - must now hold a Digital Token Service Provider (DTSP) license. But here’s the catch: MAS says they’ll only grant these licenses in extremely limited circumstances. To even qualify, you need:- A minimum capital reserve of SGD 5 million (about USD 3.7 million)

- A full-time, Singapore-based compliance officer with proven AML/CFT experience

- Annual independent audits by a MAS-approved firm

- Full implementation of the Travel Rule for all transactions over SGD 1,500

- Robust cybersecurity systems meeting MAS’s technical standards

- Customer suitability assessments and clear risk disclosures

Consumer Protections: No More Credit Card Crypto Buys

MAS doesn’t just care about banks and regulators. They care about everyday users. In September 2024, they banned crypto purchases using credit cards. Why? Because people were racking up debt on risky assets without understanding the risks. Platforms must now:- Ask customers if they understand crypto’s volatility

- Assess whether the product fits their financial situation

- Display clear warnings about potential losses

Extraterritorial Power: Even If You’re Not in Singapore

Section 137 of the FSMA gives MAS power no other regulator has. If you’re a Singapore-incorporated company - even if your servers are in Dubai, your customers are in the U.S., and your team works remotely - MAS still controls you. You can’t avoid the rules by moving your operations overseas. The law follows the company’s legal home, not its physical location. This has forced many international firms to either:- Shut down their Singapore entity entirely

- Build a full local team with a physical office and qualified compliance staff

- Reincorporate in another jurisdiction like Switzerland or the UAE

Penalties Are Severe - No Second Chances

MAS doesn’t warn. They don’t negotiate. If you’re caught operating without a license after June 30, 2025:- You face fines up to SGD 200,000 (USD 147,000)

- Executives can be jailed

- Your business must shut down immediately

The Human Cost: Jobs, Salaries, and Brain Drain

The cost of compliance isn’t just technical - it’s human. A qualified Singapore-based compliance officer now earns between SGD 150,000 and SGD 250,000 a year. That’s more than most startups can afford. Many firms had to lay off staff or cancel expansion plans. LinkedIn data shows crypto-related job postings in Singapore dropped 37% in Q1 2025 compared to Q4 2024. Some firms tried to hire offshore compliance staff - but MAS requires the officer to be physically based in Singapore. That means relocating someone, paying for housing, visas, and local taxes. For a small firm, that’s a dealbreaker.Who’s Left? Only the Elite

Before June 2025, around 200 firms had applied for or held provisional DTSP licenses. Now, experts estimate only 15 to 20 will remain fully compliant. These aren’t random startups. They’re well-funded firms with deep pockets - like traditional finance players moving into crypto, or global exchanges with existing compliance infrastructure. Smaller players? They’re gone. Or they’ve moved to places like Switzerland, Dubai, or Malta, where licensing is still active and the rules are clearer.

How This Compares to the Rest of the World

Singapore’s approach is extreme - even by global standards. - Switzerland: Offers clear licensing paths. Firms can operate with reasonable oversight and no hard cap on licenses. Many crypto startups still choose Zurich. - United Arab Emirates: Abu Dhabi and Dubai actively court crypto firms with tax breaks and fast-track licensing. They’re growing their crypto hubs fast. - United States: Patchwork regulation, but no outright ban on new licenses. Firms can operate under state-level rules. Singapore chose to prioritize reputation over growth. They didn’t want to be the next Cyprus or Panama - a place known for shady crypto activity disguised as legitimacy. But in doing so, they’ve also shut the door on innovation.What’s Next for MAS?

MAS hasn’t said they’re done. In May 2025, they hinted at new guidance coming for DeFi protocols and stablecoins by late 2025. Stablecoins are already under strict rules - they must be fully backed and audited to ensure they don’t lose value. Expect more rules on:- Decentralized exchanges

- Stablecoin issuers

- Tokenized assets like real estate or bonds

Final Reality Check

Singapore’s crypto scene isn’t dead. It’s been winnowed down to a handful of elite players. The country still has world-class banking, legal systems, and tech talent. But if you’re a startup founder looking to launch a crypto exchange or wallet, Singapore is no longer the place. The MAS crypto oversight framework isn’t about stopping bad actors. It’s about making sure only the most responsible, well-resourced firms get to play. And for everyone else? The door is closed.For those still operating in Singapore: make sure your compliance officer is local, your Travel Rule system is live, and your audits are up to date. One missed step could mean losing everything.

Can I still trade crypto in Singapore if I’m a retail user?

Yes, retail users can still buy and hold crypto in Singapore. The MAS rules target service providers - exchanges, wallets, trading platforms - not individual traders. But platforms serving Singapore customers must now follow strict rules: they can’t let you buy crypto with a credit card, they must warn you about risks, and they must verify your identity. You can still trade, but the platforms you use have to be licensed and compliant.

What happens if a crypto firm ignores the MAS deadline?

If a crypto firm operates without a DTSP license after June 30, 2025, MAS can immediately shut it down. The firm faces fines up to SGD 200,000, and its executives could be jailed. MAS has already begun taking enforcement action against unlicensed platforms. There are no warnings or grace periods - the law is applied strictly and immediately.

Do I need a DTSP license if I run a crypto business from outside Singapore?

Only if your company is legally registered in Singapore. MAS’s rules apply to any entity incorporated in Singapore, no matter where your servers, customers, or team are located. So if your business is incorporated in Singapore - even if you work remotely from Thailand - you must comply. If your company is registered elsewhere, like in the UK or the U.S., MAS has no direct authority over you - unless you’re actively marketing to Singapore residents.

Is it still possible to get a DTSP license in 2025?

Technically yes, but it’s nearly impossible. MAS has stated they will issue licenses only in "extremely limited circumstances." That means you’d need to prove you have elite compliance infrastructure, a strong operational reason to be based in Singapore, and the financial capacity to meet all requirements - including hiring a local compliance officer and spending hundreds of thousands on systems. Most experts believe only existing license holders will be renewed, and no new applicants will be approved.

How does MAS’s approach compare to other countries?

MAS’s approach is among the strictest in the world. While countries like Switzerland and the UAE offer clear, accessible licensing for crypto firms, Singapore has effectively closed the door to new entrants. Other jurisdictions focus on balancing innovation and safety. Singapore focuses only on safety - even if it means losing its position as a crypto hub. The result is a smaller, more controlled industry with far fewer players, but one that’s less likely to be linked to financial crime.

Steven Lam

November 6, 2025 AT 09:25Bro this is why America needs to stop letting other countries dictate crypto rules

Noah Roelofsn

November 7, 2025 AT 12:13Singapore didn’t kill crypto-they just filtered out the fly-by-night operators who treated their regulatory brand like a free pass to launder money. The Travel Rule alone kills 90% of these sketchy startups. If you can’t afford $200K in compliance tech and a local AML officer, you never should’ve been in the game anyway. This isn’t overreach-it’s hygiene.

Sierra Rustami

November 8, 2025 AT 11:28USA could never do this. Too many lobbyists and crypto bros with McMansions. Singapore’s got balls. Let the weak fail.

Glen Meyer

November 9, 2025 AT 19:18Another tiny island thinking it’s the financial god of the world. Who the hell does MAS think they are? We got Coinbase, Kraken, Binance US-real players. Singapore’s just mad their little tax haven is losing relevance.

Christopher Evans

November 11, 2025 AT 10:23The extraterritorial reach of Section 137 is legally unprecedented. It effectively treats corporate domicile as a permanent regulatory tether, regardless of operational geography. This sets a dangerous precedent for global financial regulation-if one jurisdiction can bind entities based on incorporation alone, we risk a Balkanized internet of compliance regimes.

Ryan McCarthy

November 13, 2025 AT 00:52I get why MAS did this. It’s not about crushing innovation-it’s about protecting the integrity of a system that took decades to build. The fact that they banned credit card crypto buys? That’s protecting real people from themselves. Maybe other countries should take notes instead of calling it ‘authoritarian.’

Leo Lanham

November 13, 2025 AT 08:39So what? They killed the dream. Now the only crypto left is for billionaires and banks. Where’s the fun in that? It’s like banning skateboarding because someone got hurt.

Whitney Fleras

November 14, 2025 AT 02:43It’s sad to see so many small teams pushed out, but I also understand why MAS had to act. Imagine if a Singapore-registered exchange got used for ransomware payments-it’d ruin trust in the whole system. Sometimes protection means saying no, even when it hurts.

Colin Byrne

November 15, 2025 AT 14:39Let’s be honest: Singapore didn’t ban crypto, they banned the illusion of legitimacy. These firms weren’t building infrastructure-they were renting a flag. The $5M capital requirement isn’t arbitrary; it’s the cost of being taken seriously. If you think this is harsh, go look at the AML reports from 2023-half the ‘Singapore-based’ exchanges had zero local staff. MAS didn’t overreact. They just finally stopped pretending.

And yes, the job losses are real. But let’s not romanticize the chaos. Those ‘startups’ were often just offshore shell companies with a LinkedIn page and a crypto newsletter. The compliance officer they hired? Probably a 22-year-old intern who read a whitepaper last week. This isn’t brain drain-it’s a correction.

Switzerland and Dubai are thriving because they’re building ecosystems. Singapore is building a fortress. One invites innovation. The other demands accountability. Neither is wrong. But if you’re running a business that depends on regulatory arbitrage, you were never meant to last.

And before anyone says ‘but crypto is decentralized!’-yes, the tech is. But the legal entity isn’t. You can’t have it both ways. You can’t use a national regulator’s stamp to attract customers and then claim you’re above their rules. That’s not freedom. That’s fraud.

The real tragedy isn’t the 180 firms that vanished. It’s that the public will forget this ever happened. They’ll just see ‘Singapore banned crypto’ and think it’s anti-innovation. But the truth? Singapore just stopped being a convenient cover for bad actors. And that’s not a loss. That’s a win.

Brian Webb

November 16, 2025 AT 14:29Reading this made me think about my cousin who quit his finance job in Toronto to start a crypto wallet startup in Singapore last year. He had a team of three, rented a co-working space, and called it ‘MAS-compliant’ because he hired a lawyer in KL to draft his T&Cs. He got shut down in July. Now he’s back in Canada, working at a bank. I told him he should’ve just stayed put. He said he didn’t believe it would happen so fast. Turns out, MAS doesn’t play games.