Taiwan VASP Registration Checker

Check Your Crypto Exchange

Enter the name of a cryptocurrency exchange to verify if it's officially registered with Taiwan's Financial Supervisory Commission (FSC).

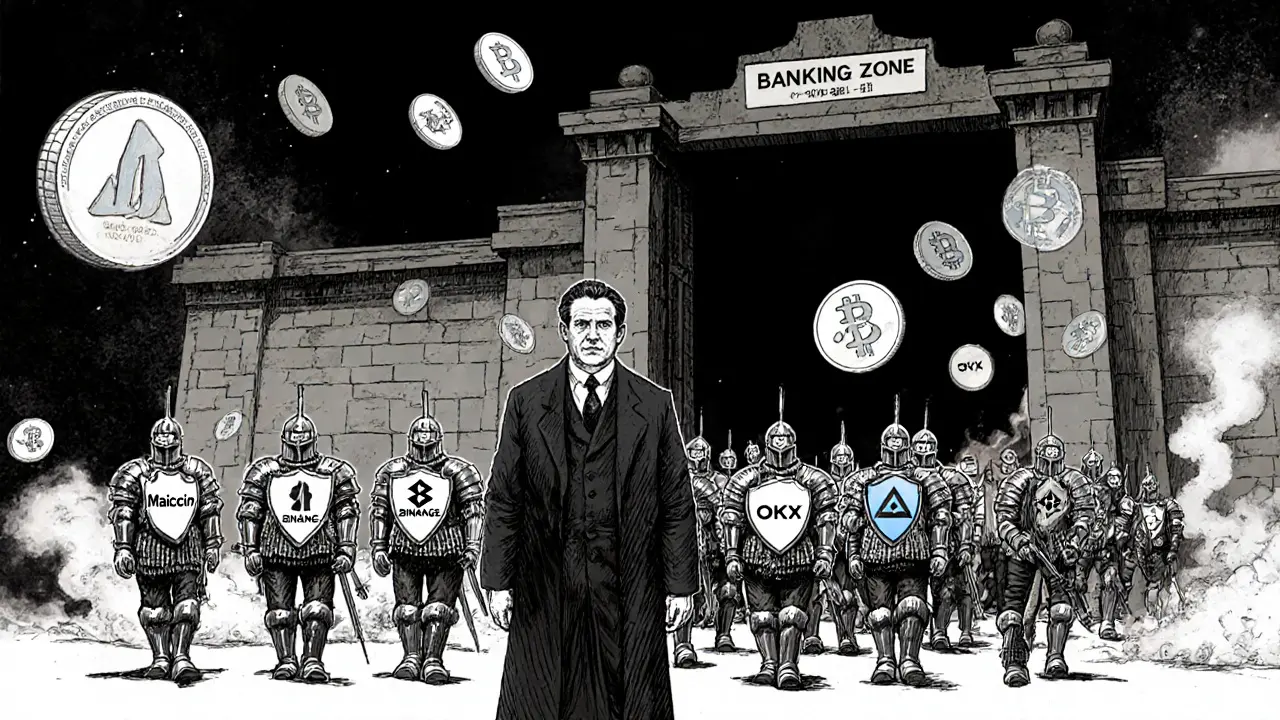

Taiwan doesn’t ban cryptocurrency. But if you think you can just use your bank account to buy Bitcoin or Ethereum like you would stocks or groceries, you’re wrong. The reality is far more complicated. Since 2013, Taiwan’s regulators have drawn a hard line: crypto is allowed, but banks are not allowed to touch it. This isn’t about stopping people from owning digital assets-it’s about keeping the banking system clean, safe, and separate from the wilder side of crypto.

Why Banks Can’t Touch Crypto in Taiwan

It started in 2013 when Taiwan’s Financial Supervisory Commission (FSC) called Bitcoin a “highly speculative digital virtual commodity,” not money. That label stuck. By 2014, banks were officially barred from handling Bitcoin transactions. No exchanges. No wallet services. No converting NT$ to BTC. Even credit card companies got the message: in 2022, they were told to stop letting people buy crypto with credit cards-same as gambling or stock trading. This isn’t about being anti-innovation. It’s about risk control. Regulators saw what happened elsewhere: crypto exchanges collapsing, money laundering through anonymous wallets, and ordinary people losing life savings. Taiwan decided to isolate the risk. Banks handle savings, loans, and payments. Crypto? That’s a separate playground.The VASP Rule: How Crypto Still Works in Taiwan

If banks can’t help, how do people trade crypto? Enter the Virtual Asset Service Provider (VASP) system. Starting January 1, 2025, any crypto exchange or service operating in Taiwan must register with the FSC. No registration? Fine up to NT$5 million (about $155,900) or jail time for up to two years. As of late 2024, only 23 companies made it through the process. The biggest is MaiCoin, handling around $70 million in daily trades. These platforms aren’t banks, but they’re regulated. They must keep customer funds separate, use strong cybersecurity, and report suspicious activity. It’s not perfect, but it’s the only legal way to trade crypto inside Taiwan. Users don’t go to their local bank to deposit money into MaiCoin. Instead, they use third-party payment processors, peer-to-peer platforms, or even cash deposits at convenience stores. Some use international exchanges like Binance or OKX-but only if those platforms are also registered as VASPs in Taiwan. That’s why local reviews show higher satisfaction for international VASPs: they offer better features, even if they’re not based in Taiwan.Stablecoins Are the New Frontier

The biggest shift coming in 2025 isn’t about Bitcoin or Ethereum. It’s about stablecoins-digital coins pegged to real money. Right now, most people in Taiwan use USDT or USDC. But those are foreign, unregulated, and outside the banking system. Starting June 2025, the FSC will launch rules for New Taiwan Dollar (TWD)-pegged stablecoins. And here’s the twist: regulated financial institutions may be allowed to issue them. That means banks could eventually offer TWD-backed digital tokens-under strict government control. This isn’t a reversal of the banking ban. It’s a controlled expansion. The goal? Replace risky, offshore stablecoins with a safe, local alternative. Think of it like digital cash issued by the Central Bank, not by a private company in the Cayman Islands.

Who’s Using Crypto in Taiwan?

Despite the restrictions, crypto adoption is growing. About 2.3 million people in Taiwan-roughly 10% of the population-own some form of digital asset as of late 2024. Daily trading volume hits $200 million, with Bitcoin and Ethereum making up two-thirds of activity. That’s not small. Most users are retail investors, not institutions. They’re young professionals, tech workers, and small business owners looking for alternatives to traditional savings. They’re not trying to break the system-they’re working around it. Reddit threads from r/Taiwan and r/cryptocurrency are full of tips on how to deposit funds legally, which VASPs have the fastest withdrawals, and how to avoid scams.The Hidden Costs of the Ban

For crypto companies, operating in Taiwan is expensive and slow. Setting up a VASP costs between NT$2 million and NT$5 million ($62,000-$155,900) just for compliance: legal fees, cybersecurity audits, AML software, and staff training. Many startups spend 3-6 months just getting approved. Even after registration, they struggle to find banks that will help them with basic business needs. Payroll. Vendor payments. Rent. Most VASPs have to use offshore accounts or rely on fintech partners that aren’t fully regulated. That creates friction. It makes scaling harder. It pushes some companies to move operations overseas. The Taiwan Virtual Asset Service Provider Association, formed in June 2024, tries to fill the gap with self-regulation and guidance. But without access to the banking system, even compliant businesses feel handcuffed.What’s Next? CBDC and the Future of Digital Money

Taiwan isn’t just reacting-it’s planning ahead. In December 2023, the Central Bank finished a feasibility study for a Central Bank Digital Currency (CBDC), or digital New Taiwan Dollar. Prototype testing began in late 2024 using the same infrastructure that runs the government’s digital vouchers for tourism and welfare. If the CBDC launches successfully, it could change everything. A government-backed digital currency, issued through banks, could eventually replace the need for private stablecoins. It could even make the current banking restrictions look outdated. Experts believe this is the real endgame: not lifting the ban on crypto, but replacing the need for it. A CBDC gives people the speed and convenience of digital money without the volatility or risk of Bitcoin. It keeps the banking system in control. It satisfies the public’s demand for innovation-without opening the floodgates to speculation.

Is Taiwan’s Approach Working?

PwC Taiwan says the VASP system improves consumer protection. Legal analysts from Global Legal Insights call it “cautious but not prohibitive.” That’s accurate. People can still buy crypto. They can still trade. They can still profit. But they can’t do it through their savings account. They can’t use their credit card. They can’t get a loan backed by their Bitcoin. That’s the trade-off. Some call it outdated. Others call it smart. In a world where crypto collapses wipe out billions, Taiwan chose stability over speed. It’s not the most exciting model-but it’s one of the few that hasn’t had a major crypto bank failure.What Should You Do If You’re in Taiwan?

If you want to trade crypto in Taiwan:- Use only FSC-registered VASPs (check the official list on the FSC website).

- Avoid using credit cards for crypto purchases-it’s blocked and risky.

- Use peer-to-peer platforms or third-party payment gateways to deposit NT$.

- Don’t trust unregistered exchanges, even if they’re popular abroad.

- Keep records of all transactions for tax purposes-Taiwan taxes crypto gains.

Can I use my bank account to buy Bitcoin in Taiwan?

No. Taiwanese banks are legally prohibited from handling any cryptocurrency transactions, including deposits, withdrawals, or exchanges. You must use registered Virtual Asset Service Providers (VASPs) and third-party payment methods like peer-to-peer platforms or approved fintech gateways.

Are crypto exchanges legal in Taiwan?

Yes, but only if they’re registered with the Financial Supervisory Commission (FSC) as a Virtual Asset Service Provider (VASP). As of 2025, only 23 exchanges have completed registration. Unregistered platforms operate illegally and carry high risk.

What happens if I use an unregistered crypto exchange?

You won’t be arrested for buying crypto, but the exchange you use could be shut down. Your funds may disappear without recourse. The FSC warns users to only use registered VASPs to protect their assets and avoid scams.

Will Taiwan allow banks to offer crypto services in the future?

Not for Bitcoin or Ethereum. But starting in June 2025, regulated financial institutions may be allowed to issue government-backed New Taiwan Dollar (TWD) stablecoins. This is a controlled exception-not a full reversal of the banking ban.

Is crypto taxed in Taiwan?

Yes. Capital gains from crypto trading are taxable under Taiwan’s Income Tax Act. You must report profits from selling or exchanging digital assets. Failure to do so can result in penalties. Keep detailed records of all transactions.

What’s the difference between a VASP and a bank in Taiwan’s crypto system?

A VASP is a registered crypto exchange or service provider that handles buying, selling, and storing digital assets. A bank is a traditional financial institution regulated to hold deposits, issue loans, and process payments. Banks cannot interact with VASPs directly. They’re kept separate by law to prevent systemic financial risk.

Can I use USDT or USDC in Taiwan?

Yes, but only if they’re traded through an FSC-registered VASP. Using unregistered platforms to hold or trade USDT/USDC is risky and potentially illegal. The FSC plans to replace these with government-backed TWD stablecoins starting in June 2025.

Marcia Birgen

November 17, 2025 AT 11:01Jerrad Kyle

November 19, 2025 AT 06:43Usama Ahmad

November 19, 2025 AT 20:13Nathan Ross

November 21, 2025 AT 09:40garrett goggin

November 21, 2025 AT 16:47Bill Henry

November 22, 2025 AT 08:44Jess Zafarris

November 22, 2025 AT 21:18Mike Gransky

November 24, 2025 AT 17:06Ella Davies

November 25, 2025 AT 12:03Henry Lu

November 25, 2025 AT 17:57nikhil .m445

November 26, 2025 AT 08:47Rick Mendoza

November 27, 2025 AT 23:51Lori Holton

November 29, 2025 AT 12:32Bruce Murray

November 29, 2025 AT 20:29Aryan Juned

December 1, 2025 AT 20:27Marcia Birgen

December 3, 2025 AT 04:37